What's Happening?

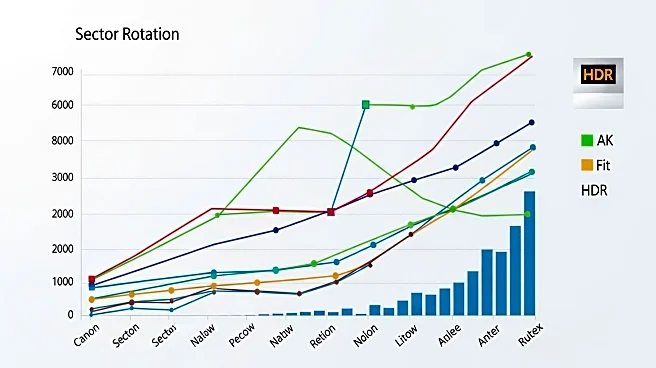

E*TRADE from Morgan Stanley has published its monthly sector rotation study, analyzing customer behavior in buying and selling stocks within the S&P 500 sectors. This study provides insights into the investment trends and preferences of E*TRADE customers, highlighting shifts in sector allocations. The data is part of E*TRADE's broader financial services offerings, which include securities products, advisory services, and stock plan administration solutions. The study is intended for educational purposes and does not constitute specific investment advice.

Why It's Important?

The sector rotation study by E*TRADE from Morgan Stanley offers valuable insights into market dynamics and investor sentiment, which can influence investment strategies and portfolio management. Understanding sector rotation is crucial for investors seeking to optimize returns by adjusting their exposure to different industries based on economic cycles and market conditions. This information can help investors make informed decisions about asset allocation and risk management, potentially enhancing their investment outcomes.