What's Happening?

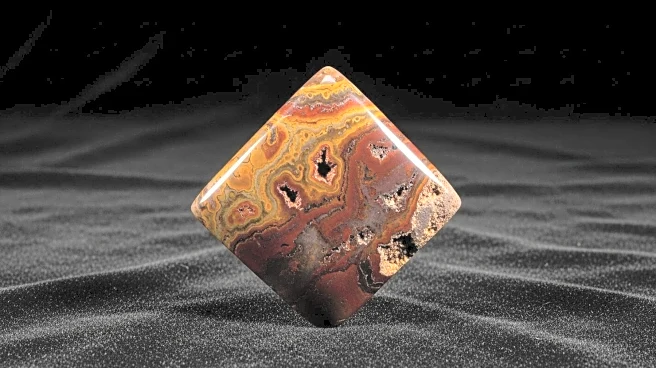

Midwest, a company specializing in natural stone mining and exporting, has initiated its Initial Public Offering (IPO) to raise Rs 451 crore. The IPO, which opened on October 15 and will close on October 17,

includes a fresh issue of Rs 250 crore and an offer for sale of Rs 201 crore. The price band is set between Rs 1,014 and Rs 1,065 per share, with a minimum bid requirement of 14 shares. Midwest operates 16 granite mines in Telangana and Andhra Pradesh and exports to 17 countries. The company has demonstrated strong financial performance, with a revenue increase of 7% to Rs 643 crore and a profit rise of 33% to Rs 133 crore in FY25. The funds raised will be used for expansion initiatives, including a Phase II Quartz Processing Plant, acquisition of electric dump trucks, installation of solar power systems, and prepayment of existing debt.

Why It's Important?

The IPO is significant as it reflects Midwest's strategic focus on growth and operational efficiency in the natural stone mining sector. The expansion plans, including investments in renewable energy and modern equipment, indicate a commitment to sustainable practices and increased production capacity. This move could enhance Midwest's competitive position in the global market, potentially leading to increased exports and revenue. Investors have shown moderate interest, as indicated by the grey market premium trending at 1%. The IPO provides an opportunity for investors to engage with a company poised for growth, although they must consider the inherent risks of the mining industry.

What's Next?

Following the IPO subscription period, the expected allotment date is October 20, with the listing scheduled for October 24 on BSE and NSE. Investors and market analysts will closely monitor the stock's performance post-listing, assessing the impact of Midwest's expansion plans on its financial health and market position. The company's focus on renewable energy and debt reduction may attract environmentally conscious investors and improve its long-term sustainability. Stakeholders will also watch for any shifts in market sentiment that could affect the stock's valuation.

Beyond the Headlines

Midwest's IPO and expansion plans highlight broader trends in the mining industry, such as the integration of renewable energy and advanced technology to improve efficiency and reduce environmental impact. This approach aligns with global efforts to promote sustainable mining practices, potentially influencing other companies in the sector to adopt similar strategies. The success of Midwest's IPO could serve as a benchmark for future public offerings in the industry, encouraging more companies to pursue growth through public investment.