What is the story about?

What's Happening?

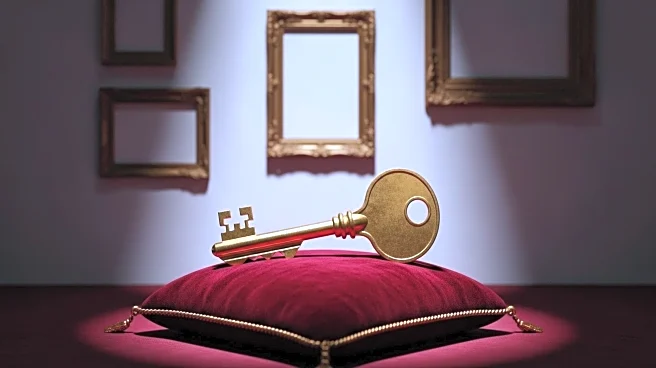

Sotheby’s is actively seeking a guarantor for Leonard Lauder’s collection of Klimt paintings, valued at $300 million, as the art market faces challenges. Recent mid-season auctions at major houses like Christie’s, Sotheby’s, and Phillips have seen a significant number of unsold lots, indicating a struggling market. The auction sales have declined by 8.8% in the first half of 2025 compared to the same period in 2024. The ultra-contemporary segment has contracted the most, with a 31.3% drop in sales. Despite these challenges, Sotheby’s is optimistic about the Klimt collection, which includes three paintings with impeccable provenance. The house is hoping to find a single backer for the entire collection, which is considered a significant opportunity in the art world.

Why It's Important?

The search for a guarantor for Lauder’s Klimt collection highlights the current volatility in the art market. The decline in auction sales reflects broader economic uncertainties and shifts in collector preferences. The success or failure of securing a guarantor could impact Sotheby’s financial outcomes and influence future auction strategies. High-value art pieces like Klimt’s are rare, and their sale can set benchmarks for the market. The involvement of high-profile collectors or investors could stabilize or further disrupt market dynamics. This situation underscores the importance of provenance and market timing in art investments.

What's Next?

Sotheby’s is preparing for the November auction in New York, which will be a critical test for the art market. The outcome of the Klimt sale could influence future auction strategies and market confidence. Potential guarantors include billionaires and art investors who may see this as a unique opportunity. The art world is watching closely to see if Sotheby’s can secure a backer and how the auction will perform. The results could provide insights into the market’s direction and the appetite for high-value art pieces.

Beyond the Headlines

The search for a guarantor for the Klimt collection raises questions about the role of financial backing in art sales. It highlights the intersection of art and investment, where financial strategies can significantly impact cultural heritage. The involvement of high-profile investors could shift perceptions of art as an asset class. This situation also reflects broader economic trends, where art is seen as a stable investment amid market fluctuations.