What is the story about?

What's Happening?

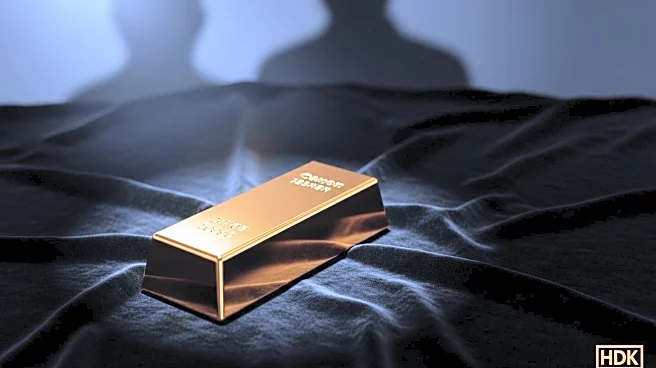

Gold prices have reached record highs, driven by investor concerns over the ongoing government shutdown and its potential economic impact. Despite assurances from analysts that market volatility will be short-lived, investors are turning to gold as a safe-haven asset. The price of gold has surged over 45% in the past year, outperforming the S&P 500, as central banks and private investors increase their holdings.

Why It's Important?

The rally in gold prices reflects broader economic uncertainties and the desire for stability in volatile times. As a traditional safe-haven asset, gold's rising value indicates that investors are seeking protection against potential economic downturns and geopolitical risks. The increased demand for gold also highlights concerns about the sustainability of current market conditions and the potential for future disruptions.

What's Next?

Analysts predict that gold prices could continue to rise, with some forecasting a price of $4,000 per troy ounce by mid-2026. Central banks are expected to increase their gold reserves, further driving demand. Investors will be closely watching economic indicators and government actions to assess the potential impact on gold prices and broader market stability.

Beyond the Headlines

The surge in gold prices underscores the importance of diversification in investment portfolios, particularly in times of economic uncertainty. It also highlights the role of gold as a hedge against inflation and currency devaluation, as well as its appeal as a politically neutral reserve asset.