What's Happening?

Netflix experienced a significant drop in its stock price following the release of its third-quarter earnings report, which failed to meet analysts' expectations. The company's earnings per share were

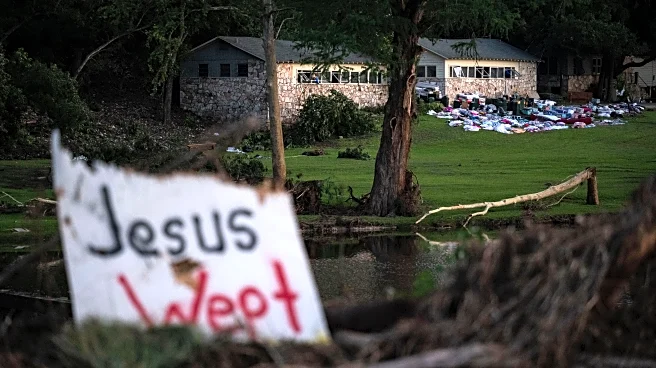

lower than anticipated, primarily due to a one-time expense related to a tax dispute with Brazilian authorities. This financial shortfall led to a more than 7% decrease in Netflix's stock value overnight. Despite the earnings miss, Netflix reported a 17% year-over-year increase in revenue, reaching approximately $11.5 billion. The company also highlighted its strong ad sales and an increase in paid memberships, with about 50 million new subscribers added in 2025. Netflix continues to lead the streaming market with 302 million paid global subscribers, significantly outpacing competitors like Disney+ and Amazon Prime Video.

Why It's Important?

The earnings miss and subsequent stock decline highlight the challenges Netflix faces in maintaining its growth trajectory amidst increasing competition and regulatory hurdles. The Brazilian tax dispute underscores the complexities of operating in international markets, which can impact financial performance. Despite these challenges, Netflix's continued subscriber growth and strong ad sales indicate resilience and potential for future revenue generation. The company's leadership in the streaming industry remains strong, but the financial markets' reaction to the earnings report suggests that investors are closely monitoring Netflix's ability to navigate these challenges and sustain its market position.

What's Next?

Netflix's future performance will likely depend on its ability to resolve the Brazilian tax issue and continue expanding its subscriber base. The company has reaffirmed its full-year revenue guidance and operating margin targets, suggesting confidence in its strategic direction. Analysts will be watching how Netflix leverages its content slate, including upcoming releases and live events, to drive subscriber engagement and revenue. Additionally, Netflix's investments in new initiatives, such as its ad-supported tier and video gaming, will be critical in maintaining its competitive edge and addressing market expectations.