What's Happening?

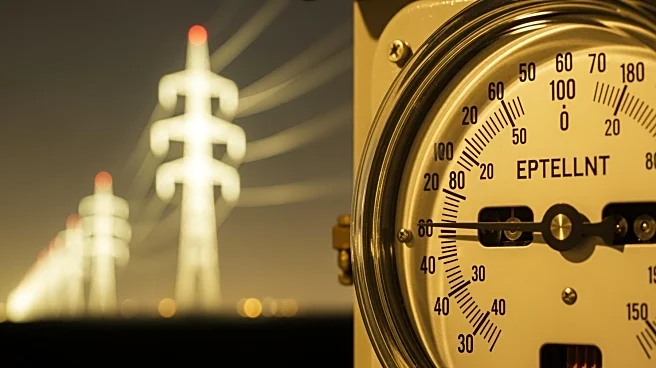

The California Public Utilities Commission has decided to lower the profit margins that utilities can earn on infrastructure investments. This decision is aimed at controlling the rising electricity bills in the state. The commission's move comes as a response

to the need for utilities to invest heavily in grid improvements to prevent catastrophic wildfires, which have been a significant issue in California. The decision affects major utilities such as PG&E Corp., Edison International, and San Diego Gas & Electric, setting their returns at a range of 9.78% to 10.03%, slightly above the national average of 9.72%. Previously, these utilities had requested higher returns, with PG&E asking for 11.3%, SoCal Edison for 11.75%, and SDG&E for 11.25%. The commission's decision reflects a balance between encouraging necessary infrastructure investments and protecting consumers from further increases in utility bills.

Why It's Important?

This decision by the California Public Utilities Commission is significant as it addresses the dual challenge of ensuring grid reliability and affordability for consumers. By capping the profits utilities can earn, the commission aims to prevent excessive cost burdens on consumers while still promoting necessary investments in grid infrastructure. This is particularly crucial in California, where wildfires have caused extensive damage and highlighted the need for a more resilient power grid. The decision could set a precedent for other states facing similar challenges, influencing how utility profits are regulated in the context of climate change and infrastructure resilience. It also underscores the ongoing tension between utility companies' financial interests and consumer protection, a dynamic that is likely to continue as states grapple with the impacts of climate change.

What's Next?

Following this decision, utilities like PG&E, Edison International, and San Diego Gas & Electric will need to adjust their financial strategies to align with the new profit margins. This may involve reassessing their investment plans and operational efficiencies to maintain profitability while complying with the commission's regulations. Additionally, there may be further discussions and negotiations between the utilities and the commission regarding future infrastructure projects and their funding. Stakeholders, including consumer advocacy groups and environmental organizations, are likely to continue monitoring the situation to ensure that the balance between infrastructure investment and consumer protection is maintained.