What's Happening?

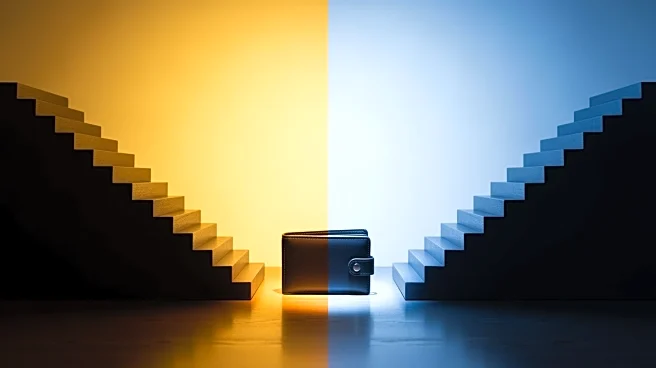

The U.S. economy is experiencing a widening gap between higher-income and middle-income households, according to data from the Bank of America Institute. While spending growth for higher-income Americans remained stable, it slowed for lower- and middle-income households.

This divergence is described as a 'K-shaped' economy, where financial stress is increasingly affecting middle-income consumers aged 45 to 60. The National Foundation for Credit Counseling reports that many consumers are reaching their borrowing capacity, unable to maintain their lifestyle through credit.

Why It's Important?

The growing financial stress among middle-income households highlights the uneven nature of the economic recovery. While higher-income individuals benefit from stock gains and homeownership, middle-income families face challenges in managing debt and maintaining spending. This disparity could lead to broader economic implications, as consumer spending is a significant driver of economic growth. The potential for increased financial strain on middle-income households may also impact social stability and economic policy decisions.

What's Next?

Larger tax refunds may provide temporary relief for some consumers, but experts warn that the underlying financial stress will likely persist. Policymakers and economists will need to address the structural issues contributing to this economic divide. The focus may shift towards creating policies that support middle-income households and address the root causes of financial stress, such as wage stagnation and rising living costs.