What's Happening?

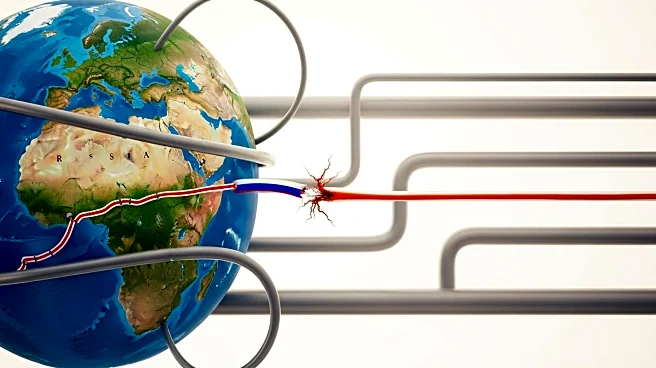

Recent sanctions imposed by Europe are set to significantly impact Russian oil imports, targeting major companies such as Lukoil and Rosneft. These sanctions aim to cripple Russian oil exports by preventing

transactions in U.S. dollars, potentially leading to a loss of up to half of Russian oil supplies. The measures could force Lukoil to divest from key international projects, affecting up to 20 percent of its revenue. Despite these sanctions, China and India, the largest buyers of Russian oil, are expected to maintain their import levels due to competitive pricing and limited alternatives.

Why It's Important?

The sanctions on Russian oil imports have broad implications for global energy markets and geopolitical relations. By targeting major Russian oil companies, the sanctions could disrupt global oil supply chains and increase energy prices. This move may also strain relations between Russia and Western countries, as President Vladimir Putin has criticized the sanctions as unfriendly and harmful to Russian-American relations. The continued purchase of Russian oil by China and India highlights the complex dynamics of international trade and the challenges of enforcing economic sanctions.

What's Next?

As the sanctions take effect, international buyers may seek alternative ways to navigate the restrictions, potentially through companies that can obscure their ties to Russia. This could lead to new trade patterns and alliances in the global oil market. Additionally, the political tensions resulting from these sanctions may prompt further diplomatic negotiations or retaliatory measures from Russia. The situation will require close monitoring as stakeholders assess the long-term impacts on energy security and international relations.

Beyond the Headlines

The sanctions on Russian oil imports underscore the ethical and political complexities of energy dependence and international trade. They raise questions about the effectiveness of economic sanctions as a tool for political leverage and the potential unintended consequences for global markets. The situation also highlights the need for countries to diversify their energy sources and reduce reliance on politically volatile regions.