What's Happening?

JTC Employer Solutions Trustee Ltd has decreased its stake in Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) by 12.8% during the second quarter, as disclosed in a recent filing with the Securities

and Exchange Commission. The institutional investor sold 9,000 shares, reducing its holdings to 61,101 shares, valued at approximately $13.83 million. This adjustment makes TSMC the ninth largest holding in JTC's portfolio, accounting for 1.3% of its total investments. Other institutional investors have also been active in trading TSMC shares, with some increasing their positions, such as DekaBank Deutsche Girozentrale and Hudson Edge Investment Partners Inc., while others like Powers Advisory Group LLC have initiated new stakes. TSMC's stock has been a focal point for investors, with a market cap of $1.53 trillion and a recent quarterly earnings report that exceeded expectations.

Why It's Important?

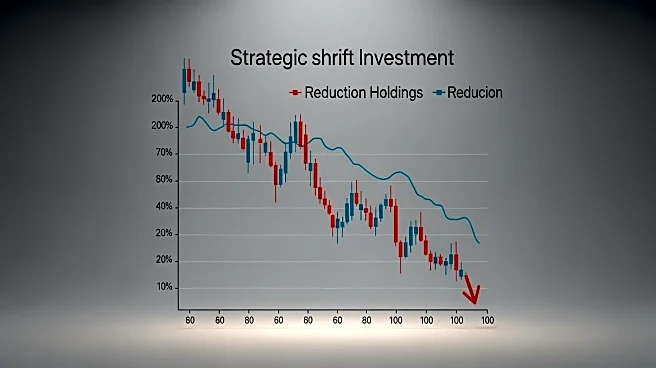

The reduction in holdings by JTC Employer Solutions Trustee Ltd reflects a strategic shift that could influence other institutional investors' decisions regarding TSMC. As a major player in the semiconductor industry, TSMC's performance and stock valuation are critical indicators for the tech sector and broader market trends. The company's recent earnings report, which surpassed analyst expectations, highlights its robust financial health and potential for growth. This development is significant for U.S. investors and the semiconductor market, as TSMC's technological advancements and production capabilities are pivotal in addressing global chip shortages. The stock's performance and analyst ratings, which remain positive, suggest continued investor confidence, although strategic adjustments by major stakeholders like JTC could signal caution or reallocation of resources.

What's Next?

TSMC's future performance will likely be closely monitored by investors, especially given its role in the global semiconductor supply chain. The company's upcoming dividend increase and positive earnings outlook may attract further investment, despite JTC's recent reduction in holdings. Analysts have maintained a 'Moderate Buy' rating, with some upgrading their price targets, indicating optimism about TSMC's growth prospects. The semiconductor industry, facing ongoing supply chain challenges, will watch TSMC's strategic moves and technological innovations closely, as they could set industry standards and influence market dynamics.