What is the story about?

What's Happening?

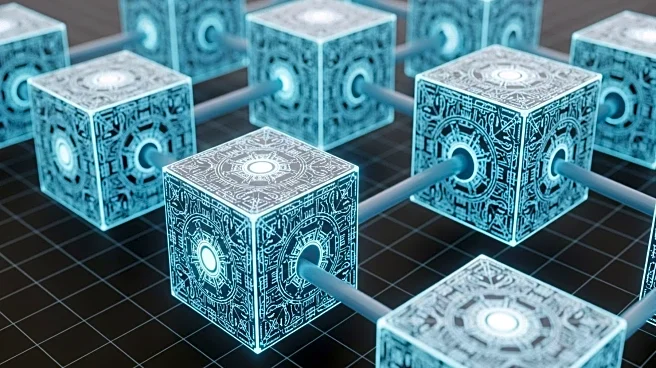

MQube, a UK-based fintech company, has tokenised £1.3bn (US$1.73bn) of mortgage debt on the blockchain through its MPowered division. This marks the first time a European mortgage lender has moved residential mortgage assets onto an Ethereum Virtual Machine compatible chain. The tokenisation process converts mortgage debt into digital tokens recorded on a distributed ledger, representing a significant advancement in the application of blockchain technology within financial services. The move reflects growing interest in blockchain applications for asset management and trading.

Why It's Important?

The tokenisation of mortgage debt by MQube represents a significant shift in the financial services industry, showcasing the potential of blockchain technology to enhance transparency, efficiency, and security in asset management. This development could pave the way for broader adoption of blockchain in various financial sectors, potentially transforming traditional banking operations. It highlights the innovative approaches fintech companies are taking to leverage technology for improved financial solutions, which could lead to increased competition and evolution in the mortgage lending market.