What's Happening?

Goldman Sachs has identified manufacturing as China's primary focus, rather than consumption, as the country navigates its economic priorities. Andrew Tilton from Goldman Sachs shared insights into global

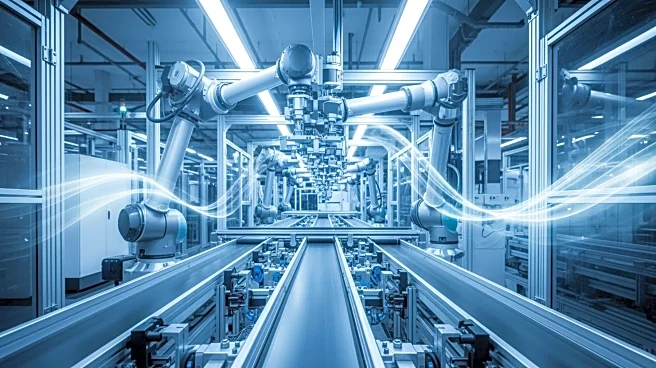

growth prospects for 2026, emphasizing China's strategic emphasis on manufacturing. This focus is expected to influence global economic dynamics, particularly as the Federal Reserve continues to cut interest rates, potentially leading to a weaker U.S. dollar. The prioritization of manufacturing over consumption reflects China's long-term economic strategy to bolster its industrial capabilities and maintain its position in the global market.

Why It's Important?

China's emphasis on manufacturing has significant implications for global trade and economic relations. By prioritizing manufacturing, China aims to strengthen its industrial base, which could lead to increased exports and influence global supply chains. This strategy may affect international markets, particularly those reliant on Chinese manufacturing. Additionally, the potential weakening of the U.S. dollar due to ongoing interest rate cuts by the Federal Reserve could impact trade balances and currency valuations. Stakeholders, including multinational corporations and investors, will need to adapt to these shifts in economic priorities and currency dynamics.