What's Happening?

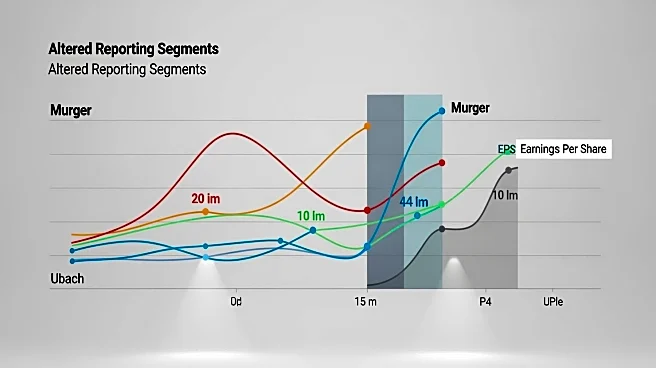

Bunge Global SA has revised its segment and volume reporting structure following its merger with Viterra Ltd. The company will now report under segments such as soybean processing and refining, softseed

processing, other oilseeds processing, and grain merchandising and milling. This change reflects the integration of Viterra, an $8.2 billion transaction completed on July 2. Bunge's full-year earnings per share (EPS) outlook for 2025 has been adjusted to a range of $7.30 to $7.60, down from the previous estimate of $7.75. The adjustment accounts for the merger's impact and aligns with current market conditions.

Why It's Important?

The updated reporting structure and EPS outlook are crucial as they provide investors with a clearer understanding of Bunge's operational dynamics post-merger. The integration of Viterra is expected to bolster Bunge's market position, although it introduces complexities such as managing fluctuating commodity prices and geopolitical tensions. The revised EPS outlook suggests cautious optimism, balancing merger benefits with external market pressures. Investors will be keen to see how Bunge leverages its expanded capabilities to drive growth and profitability.

What's Next?

Bunge plans to offer a detailed outlook during its third-quarter earnings call on November 5. The company will continue to assess the impact of global commodity market trends and geopolitical developments on its operations. Stakeholders will be watching for strategic initiatives that Bunge may undertake to enhance its competitive edge and mitigate risks associated with the merger. The company's ability to navigate these challenges will be pivotal in shaping its future performance.

Beyond the Headlines

The merger and subsequent reporting changes reflect broader industry trends towards consolidation and strategic realignment. Bunge's approach may influence other agribusiness firms considering similar moves to enhance operational efficiency and market reach. The emphasis on detailed segment reporting highlights the importance of transparency and investor engagement in managing complex business transformations.