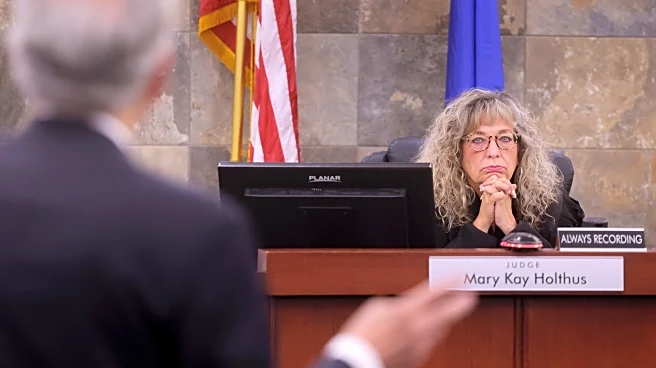

What's Happening?

The IRS has announced significant changes to the U.S. tax code for the 2026 filing season, following the enactment of the 'One Big, Beautiful Bill Act' last year. These changes include increased child tax credits, new deductions for tips, overtime pay,

and auto loan interest, as well as raised standard deductions. The child tax credit has been increased from $2,000 to $2,200 per qualifying child, applicable to all eligible taxpayers. The standard deduction has also been raised, with single filers now eligible for $15,750, heads of household for $23,625, and married couples filing jointly for $31,500. Additionally, the state and local tax deduction has been increased from $10,000 to $40,000 for incomes under $500,000. The IRS will begin accepting returns on January 26, with the filing deadline set for April 15.

Why It's Important?

These changes are poised to impact millions of American taxpayers by potentially increasing their refunds and reducing their taxable income. The increase in standard deductions and child tax credits is particularly significant for middle and lower-income families, providing them with more financial relief. The new deductions for tips, overtime, and auto loan interest aim to benefit workers and consumers, encouraging spending and investment in American-made vehicles. The quadrupling of the state and local tax deduction could incentivize taxpayers in high-tax states to itemize their deductions, potentially altering filing strategies. These adjustments reflect broader economic policies aimed at stimulating consumer spending and supporting family incomes.

What's Next?

As the IRS begins processing returns, taxpayers are encouraged to evaluate whether to take the standard deduction or itemize, based on their individual financial situations. Tax professionals and software providers will likely play a crucial role in helping filers navigate these changes. The IRS's updated withholding tables will also require employers to adjust payroll systems to ensure accurate tax withholdings. Taxpayers should consider filing electronically and opting for direct deposit to expedite refund processing. Additionally, the IRS's new reporting requirements for digital assets and online marketplace income will necessitate increased diligence from taxpayers involved in these transactions.