What is the story about?

What's Happening?

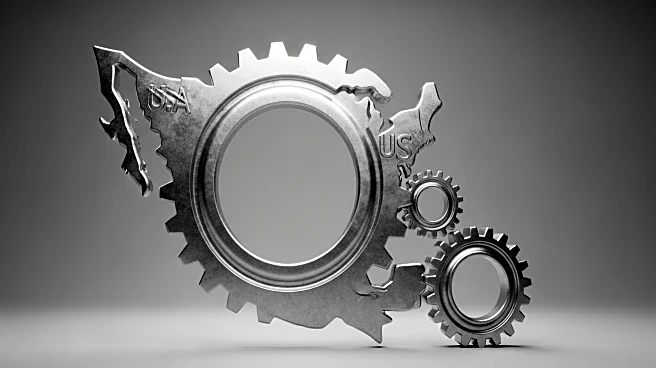

Recent changes in U.S. enforcement priorities have placed Mexico and other Latin American countries at the forefront of a new regulatory approach. This shift demands immediate attention from multinational executives, compliance officers, and risk managers. The risks associated with doing business in Mexico now resemble those in high-risk nations like Syria and Afghanistan, where U.S.-designated Foreign Terrorist Organizations hold significant influence. Companies face potential criminal exposure under U.S. national security laws if routine payments to local vendors in Mexico are reclassified as material support for terrorist organizations. This evolving landscape requires businesses to adopt meticulous risk mitigation measures, including comprehensive risk assessments, enhanced auditing, and rigorous third-party due diligence.

Why It's Important?

The shift in enforcement priorities has significant implications for U.S. businesses operating in Mexico. Companies must navigate a complex environment where cartel-linked activities are increasingly treated as national security threats. This change elevates the pace and scope of enforcement, impacting supply chains and financial transactions. Businesses face heightened scrutiny from U.S. agencies like the Department of Justice and the Office of Foreign Assets Control, which now incorporate terrorism financing and sanctions violations into their border security tactics. The potential for criminal exposure and financial losses necessitates proactive risk management strategies to ensure compliance and protect business interests.

What's Next?

Companies operating in Mexico must adapt to the new enforcement landscape by implementing proactive risk management strategies. This includes conducting thorough risk assessments, training staff on emerging risks, and enhancing third-party due diligence procedures. Businesses should also consider increased auditing and monitoring of key supply chain relationships and reconsider their voluntary disclosure posture. The Department of Justice's updated policies offer assurances for prosecutorial discretion in cases of self-reported violations, providing a strategic option for mitigating enforcement risks. As the regulatory environment continues to evolve, businesses must dedicate resources to monitor developments and compliance procedures effectively.

Beyond the Headlines

The enforcement shift highlights broader ethical and legal dimensions, as companies must balance operational needs with compliance requirements. The increased focus on cartel-linked activities underscores the importance of corporate responsibility and ethical business practices. Companies must navigate complex legal landscapes while ensuring their operations do not inadvertently support criminal activities. This development may also trigger long-term shifts in how businesses approach risk management and compliance in high-risk regions, emphasizing the need for robust internal controls and transparent business practices.