What's Happening?

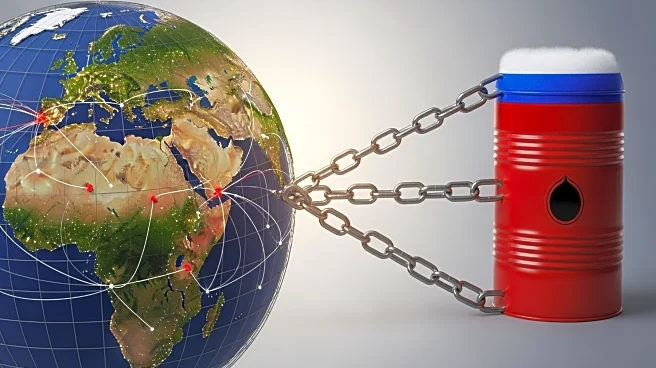

The European Union has imposed new sanctions on Russia, specifically targeting its oil and gas sectors. These measures are designed to cut into the revenue that funds Moscow's ongoing conflict in Ukraine.

The sanctions aim to increase pressure on Russia's economy by preventing transactions in U.S. dollars, which could significantly impact major Russian oil companies like Lukoil and Rosneft. Despite these sanctions, Russia's oil exports remain substantial, with China and India expected to continue their import levels due to competitive pricing and limited alternatives. Experts predict that while the sanctions will complicate exports, established work schemes may help mitigate significant damage.

Why It's Important?

The sanctions are a strategic move by the European Union to weaken Russia's economic capabilities and influence its geopolitical actions. By targeting the oil sector, the EU aims to disrupt a major source of revenue for Russia, potentially affecting its ability to finance the war in Ukraine. This development could lead to shifts in global oil trade dynamics, as countries like China and India may seek alternative sources or continue purchasing Russian oil through indirect means. The sanctions also reflect the growing tension between Russia and Western nations, with potential implications for international relations and global energy markets.

What's Next?

The effectiveness of these sanctions in forcing a change in President Putin's strategy remains uncertain. As the situation evolves, major stakeholders such as political leaders and businesses will likely monitor the impact on global oil prices and trade patterns. The Kremlin has criticized the sanctions, labeling them as unfriendly and harmful to Russian-American relations, indicating potential diplomatic repercussions. Additionally, international buyers may explore new methods to navigate the sanctions, potentially leading to innovative trade practices or increased reliance on non-Western financial systems.

Beyond the Headlines

The sanctions raise ethical and legal questions about the use of economic measures to influence geopolitical conflicts. They highlight the complex interplay between international politics and global trade, as countries balance economic interests with political objectives. Long-term shifts could include increased diversification of energy sources and a reevaluation of global dependency on Russian oil, potentially accelerating the transition to renewable energy.