What's Happening?

Palantir Technologies, a prominent big data analytics firm, has reported impressive financial performance, including a 63% year-over-year revenue growth and an increase in commercial customers from 498

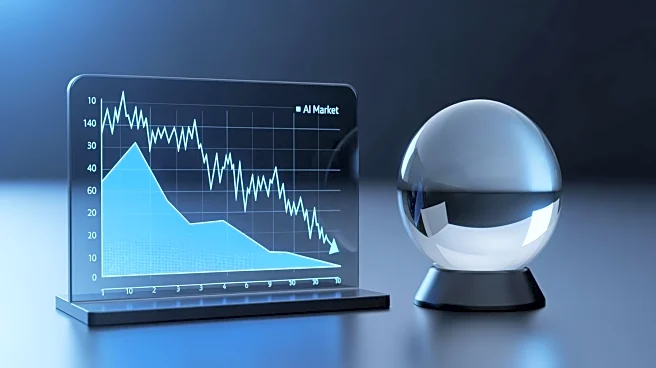

to 742. Despite these positive indicators, investor Daniel Jones has expressed concerns about the sustainability of Palantir's stock price. Jones highlights the potential risks associated with an AI market bubble, noting that the company's shares are currently trading at high multiples, which could lead to a significant drop in value if the AI market weakens. The investor's skepticism is shared by others, including Michael Burry, who has disclosed a short position against Palantir. Wall Street analysts have mixed opinions, with some recommending a hold or sell on the stock.

Why It's Important?

The concerns raised by investors like Daniel Jones about Palantir's stock valuation are significant for the broader tech industry, particularly in the context of the AI market. If the AI bubble bursts, it could lead to a reevaluation of stock prices across the sector, impacting investors and companies heavily invested in AI technologies. Palantir's situation serves as a cautionary tale for stakeholders in the tech industry, highlighting the importance of sustainable growth and realistic valuations. The potential collapse of Palantir's stock could have ripple effects, influencing investor sentiment and market dynamics in the U.S. tech sector.

What's Next?

As the AI market continues to evolve, stakeholders will be closely monitoring Palantir's financial performance and market valuation. Investors may reassess their positions based on the company's ability to maintain growth and adapt to changing market conditions. Analysts will likely continue to debate the appropriate valuation for Palantir, considering both its operational success and the broader market risks. The company's future stock performance will depend on its ability to navigate these challenges and sustain investor confidence.

Beyond the Headlines

The situation with Palantir highlights broader ethical and economic considerations in the tech industry, such as the concentration of AI spending among a few companies and the implications of speculative investment practices. The potential for an AI bubble raises questions about the sustainability of current market trends and the need for responsible investment strategies. This development may prompt discussions about regulatory measures to ensure fair competition and prevent market distortions.