What's Happening?

Cango Inc., originally an automotive transaction service platform in China, has announced a strategic transformation into the Bitcoin mining industry. This shift marks the one-year anniversary of their transition, which began in November 2024. The company

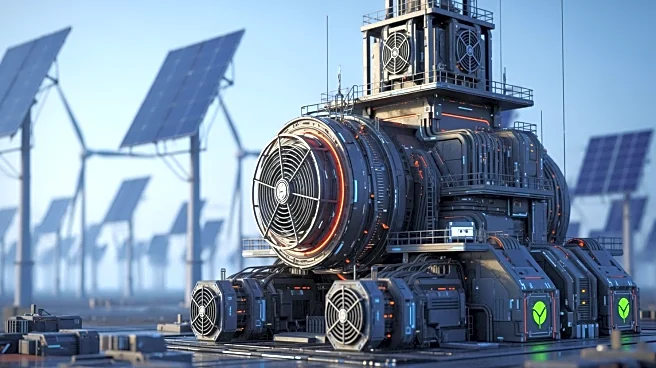

has built a 50 EH/s global platform and acquired selective energy infrastructure, positioning itself for future expansion into energy and high-performance computing (HPC). Cango's transformation involved acquiring second-hand mining machines and divesting its China-based assets to focus on Bitcoin mining. The company reported strong financial results for the second quarter of 2025, with revenue totaling $139.8 million and adjusted EBITDA of $99.1 million. Cango has also acquired a 50 MW mining facility in Georgia, USA, and plans to transition to a direct listing on the NYSE.

Why It's Important?

Cango's strategic shift to Bitcoin mining and energy infrastructure is significant as it reflects the growing trend of companies diversifying into digital assets and blockchain technology. This move positions Cango to capitalize on the increasing demand for Bitcoin and the potential for energy infrastructure to support future HPC deployments. The company's focus on operational excellence and financial discipline could enhance its competitiveness in the global market. By transitioning to a direct listing on the NYSE, Cango aims to optimize its capital structure and attract institutional investors, which could further support its growth ambitions. This transformation may impact stakeholders in the digital asset industry, energy sector, and financial markets.

What's Next?

Cango plans to execute a phased expansion into energy infrastructure and HPC, leveraging its global footprint and expertise in computational infrastructure operations. The company aims to acquire and develop dual-purpose energy assets that serve immediate Bitcoin mining needs while supporting future HPC deployments. Cango's strategy includes improving its core Bitcoin mining business by enhancing efficiency and shifting capacity to better power terms. The transition to a direct listing on the NYSE is expected to go live on November 17, 2025, which could increase transparency and align the company with global investors. These steps are designed to build credibility and create lasting value for shareholders.

Beyond the Headlines

Cango's transformation highlights the convergence of energy and computing technology, which could drive innovation in the digital asset space. The company's disciplined approach to expansion and focus on sustainable growth may set a precedent for other firms considering similar strategic shifts. The ethical and legal implications of Bitcoin mining, such as energy consumption and regulatory compliance, could influence Cango's operations and industry standards. As the company navigates this new frontier, its actions may contribute to shaping the future of compute and energy infrastructure.