What's Happening?

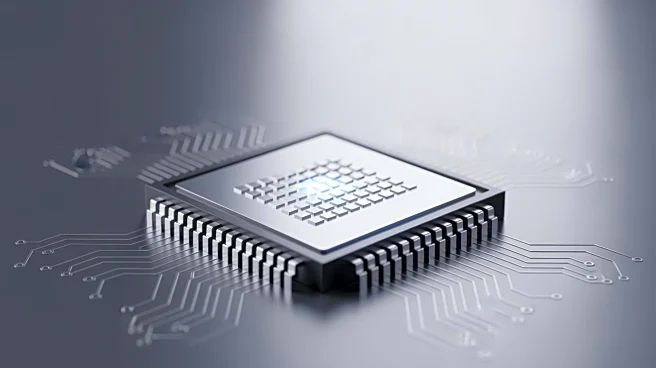

OneAscent Family Office LLC has significantly increased its holdings in Taiwan Semiconductor Manufacturing Company Ltd. (TSM) by 63.8% during the second quarter, as reported in its latest 13F filing with

the Securities & Exchange Commission. The firm now owns 3,942 shares of TSM, valued at $893,000. This move is part of a broader trend where several institutional investors have adjusted their stakes in TSM, including 1248 Management LLC and Graybill Wealth Management LTD. Analysts have recently set new price targets for TSM, with Citigroup reiterating a 'buy' rating and Barclays increasing its price target to $355. TSM's stock performance has been strong, with a market capitalization of $1.52 trillion and a recent quarterly earnings report exceeding expectations.

Why It's Important?

The increase in institutional investment in Taiwan Semiconductor Manufacturing Company reflects confidence in the company's growth prospects, particularly in the semiconductor industry, which is crucial for technological advancements globally. TSM's strong financial performance and positive analyst ratings suggest potential for continued stock appreciation, impacting investors and stakeholders in the tech sector. The company's strategic position in the semiconductor market is vital for industries reliant on advanced technology, including computing and telecommunications.

What's Next?

Taiwan Semiconductor Manufacturing Company is expected to continue its growth trajectory, supported by favorable analyst ratings and increased institutional investment. The company's upcoming dividend payment and positive earnings outlook may further attract investors. Analysts predict TSM will post 9.2 earnings per share for the current fiscal year, indicating robust financial health. Stakeholders will be watching for further developments in TSM's market strategy and potential impacts on the semiconductor industry.

Beyond the Headlines

The increased investment in TSM highlights the broader trend of institutional investors seeking opportunities in the semiconductor sector, which is pivotal for technological innovation. TSM's role in manufacturing integrated circuits positions it as a key player in global tech supply chains, influencing market dynamics and competitive strategies.