What's Happening?

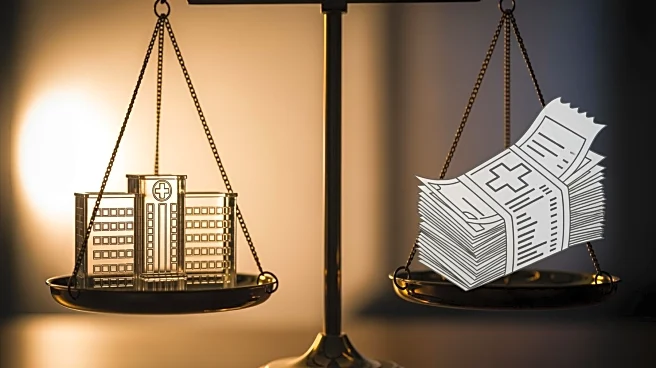

Health insurance premiums are set to rise significantly in 2026, with rates in the individual insurance markets expected to be 26% higher than the previous year. The primary drivers of these increases

are the high costs associated with hospital services and prescription drugs. These factors are impacting both employer-sponsored health coverage and plans purchased in the Affordable Care Act marketplaces. Additionally, the expiration of enhanced premium tax credits is contributing to the premium hikes, potentially forcing millions to drop their coverage. Families USA has reviewed insurers' rate filings and is urging Congress to take action to lower healthcare costs, including extending premium tax credits and holding corporate health systems accountable for excessive pricing.

Why It's Important?

The rising health insurance premiums are a significant concern for working families already burdened by high costs for healthcare, groceries, and other necessities. The potential expiration of enhanced premium tax credits could lead to a 'premium cliff,' affecting millions of families who may lose their coverage. This situation underscores the need for legislative action to address healthcare affordability and transparency. By reforming pricing practices and extending tax credits, Congress could alleviate financial pressures on families and businesses, ensuring broader access to affordable healthcare.

What's Next?

Families USA is calling on Congress to implement measures to protect families from rising healthcare costs. These include extending premium tax credits, enforcing price transparency among hospitals and health plans, and reforming payment structures to focus on quality care. The organization is advocating for immediate legislative action to prevent a significant number of Americans from losing their health insurance coverage due to unaffordable premiums.