What is the story about?

What's Happening?

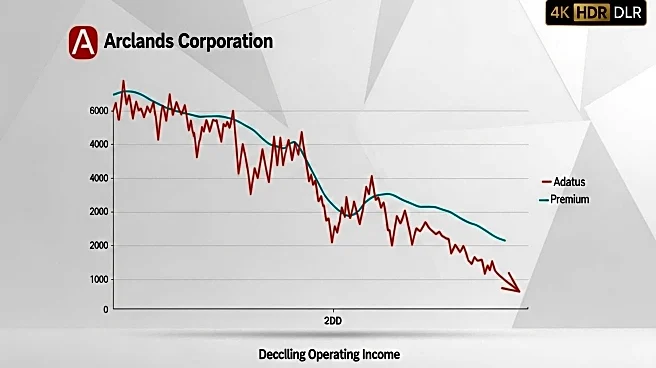

Arclands Corporation has released its consolidated financial results for the six months ending August 31, 2025. The company reported sales of 170.75 billion yen, marking a 7.3% increase compared to the same period last year. However, the operating income saw a decline of 12.8%, totaling 8.88 billion yen. Recurring income also decreased by 13.8% to 8.76 billion yen. The net income for the period was 5.68 billion yen, down 9.5% from the previous year. Despite these declines, the company maintained its annual dividend at 40.00 yen, with interim and year-end dividends of 20.00 yen each. The earnings per share (EPS) stood at 91.19 yen, a decrease from the previous year's 100.77 yen.

Why It's Important?

The financial performance of Arclands Corporation is significant as it reflects broader economic trends and challenges within the industry. The increase in sales suggests a strong market demand, yet the decline in operating and recurring income indicates rising operational costs or inefficiencies. This could impact investor confidence and influence the company's stock performance. The consistent dividend payout, despite reduced profits, may be aimed at maintaining shareholder trust. The results could prompt strategic adjustments within the company to address the income decline and improve profitability.

What's Next?

Arclands Corporation may need to explore cost-cutting measures or operational efficiencies to counteract the decline in income. The company might also consider strategic investments or restructuring to enhance its financial performance. Stakeholders, including investors and analysts, will likely monitor the company's next financial report to assess the effectiveness of any implemented strategies. Additionally, market conditions and economic factors will play a crucial role in shaping the company's future financial outcomes.

Beyond the Headlines

The financial results of Arclands Corporation could have implications for its competitive positioning in the market. The decline in income might affect its ability to invest in innovation or expansion, potentially impacting its market share. Furthermore, the company's financial health could influence its relationships with suppliers and partners, affecting its operational dynamics. The results also highlight the importance of strategic financial management in navigating economic challenges.