What is the story about?

What's Happening?

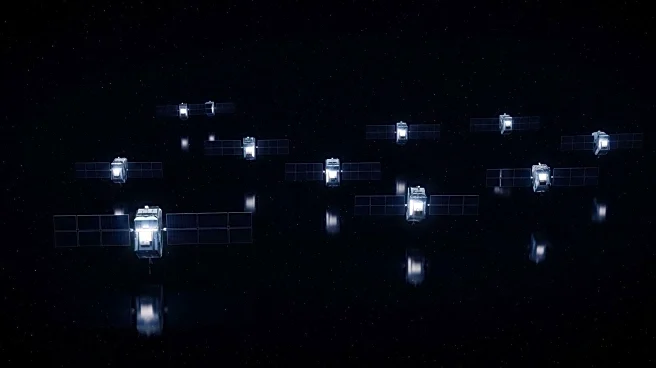

Starlink, with over 8,000 low-Earth orbit (LEO) satellites, leads the satellite broadband market but faces increasing competition, according to a MoffettNathanson report. Despite its commanding presence, Starlink's coverage gaps and the emergence of new players like Amazon's Project Kuiper and Eutelsat OneWeb suggest it won't monopolize the global market. The report highlights the substantial costs associated with LEO satellite systems and questions their long-term profitability. Multiple constellations are expected, leading to lower returns for all players, including Starlink.

Why It's Important?

The report underscores the competitive landscape in the LEO satellite market, challenging Starlink's potential to dominate globally. As new entrants like Amazon and Eutelsat expand their satellite networks, the market dynamics may shift, impacting Starlink's growth and profitability. The analysis suggests that the LEO business faces significant financial challenges, with high upfront and maintenance costs. This competitive environment may drive innovation and influence strategic decisions among satellite operators.

Beyond the Headlines

The report raises questions about the sustainability of the LEO satellite business model, given the high costs and uncertain returns. It highlights the need for operators to explore alternative revenue streams, such as military applications, to improve profitability. The competitive landscape may also lead to strategic partnerships and collaborations among satellite operators to optimize resources and enhance service offerings.