What's Happening?

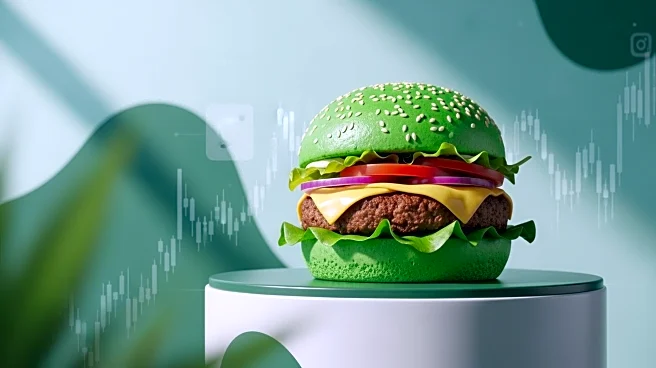

Beyond Meat experienced a dramatic 1,600% stock rally over four days, driven by social media misinformation rather than a short squeeze. The plant-based meat company's shares surged from $0.52 to as high

as $8.85, with daily trading volumes exceeding 2 billion shares. Despite claims of high short interest, the actual short interest was less than 14%, far below the figures circulated on social media. The rally was fueled by incorrect assessments and outdated data, highlighting the dangers of relying on third-party sites and social media influencers for financial information.

Why It's Important?

The surge in Beyond Meat's stock underscores the impact of social media on market dynamics, particularly in the context of meme stocks. This event highlights the risks associated with misinformation and the importance of relying on primary data sources for investment decisions. The rally reflects broader trends in the stock market where social media can significantly influence investor behavior, often leading to volatility and speculative trading. For investors and market participants, understanding the mechanics of short squeezes and the role of accurate data is crucial in navigating such scenarios.

What's Next?

As the dust settles on Beyond Meat's stock rally, investors and analysts will likely reassess the company's valuation and market position. The focus may shift to the company's fundamentals and long-term prospects, rather than short-term price movements driven by social media. Regulatory scrutiny on misinformation and its impact on stock markets could increase, prompting platforms to enhance their data accuracy and transparency. Beyond Meat may also need to address investor concerns and clarify its business strategy to stabilize its stock performance.

Beyond the Headlines

The broader implications of Beyond Meat's stock rally extend to the regulatory landscape, where misinformation and market manipulation are increasingly under scrutiny. This event may prompt discussions on the ethical responsibilities of social media platforms and financial influencers in disseminating accurate information. The rally also highlights the cultural dimensions of meme stock investing, where community-driven movements can challenge traditional market norms and influence corporate strategies.