What's Happening?

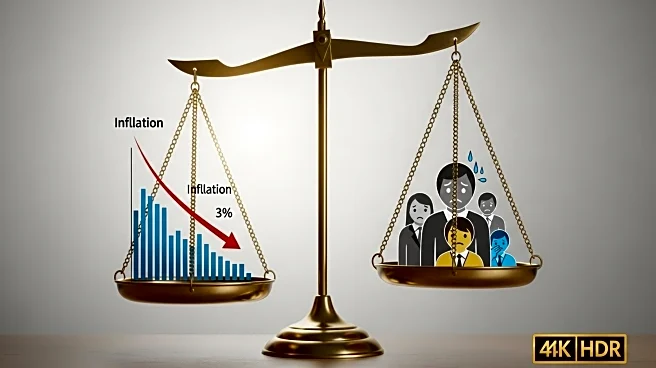

Despite official data indicating a decline in inflation since its peak during the pandemic, many Americans continue to feel the impact of high prices. NPR's Planet Money explores the discrepancy between the reported inflation figures and the public's perception of ongoing financial strain. The analysis suggests that while inflation rates have decreased, the prices of essential goods and services remain elevated, contributing to a sense of economic pressure among consumers. This divergence highlights the complexity of economic recovery and the challenges faced by individuals in adjusting to new price levels.

Why It's Important?

The ongoing perception of high prices despite falling inflation rates has significant implications for consumer behavior and economic policy. If consumers continue to feel financially strained, it could affect spending patterns, potentially slowing economic growth. This situation poses a challenge for policymakers who rely on inflation data to guide economic decisions. Understanding the disconnect between official statistics and consumer experiences is crucial for addressing public concerns and ensuring effective communication about economic conditions. Businesses may also need to adapt their strategies to accommodate consumer sentiment and maintain market stability.

What's Next?

As the economy continues to recover, monitoring consumer sentiment and spending habits will be essential for policymakers and businesses. Efforts to bridge the gap between official inflation data and public perception may involve targeted communication strategies and policy adjustments to address specific areas of concern, such as housing and food prices. Additionally, ongoing analysis of economic indicators will be necessary to ensure that recovery efforts align with the realities faced by consumers. Stakeholders may also explore initiatives to enhance financial literacy and understanding of economic trends among the public.

Beyond the Headlines

The discrepancy between inflation data and consumer perception raises questions about the effectiveness of traditional economic measures in capturing the lived experiences of individuals. This situation underscores the need for more nuanced approaches to economic analysis that consider factors such as regional price variations and the impact of non-essential goods on overall spending. It also highlights the importance of transparency in economic reporting and the role of media in shaping public understanding of complex financial issues.