What's Happening?

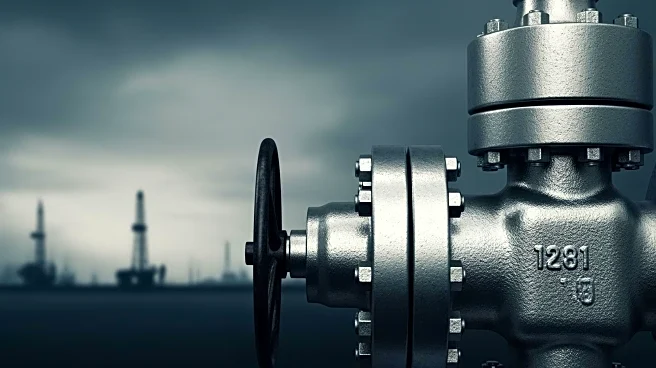

The United States has imposed sanctions on Russian oil companies Rosneft and Lukoil, leading to significant disruptions in Russian oil exports. According to JPMorgan, approximately 1.4 million barrels

per day of Russian oil, nearly a third of the country's seaborne export potential, are currently stuck in tankers due to slowed unloading processes. The sanctions, announced by President Trump, set a deadline of November 21 for winding down all dealings with the sanctioned companies. This move marks the first direct sanctions imposed on Russia by President Trump during his second term. The sanctions have forced Lukoil to declare the sale of foreign assets and disrupted operations in various countries, including Iraq, Finland, and Bulgaria. Despite these challenges, trading sources report that overall Russian oil exports have remained relatively stable.

Why It's Important?

The sanctions on Rosneft and Lukoil are significant as they directly impact the global oil market, particularly affecting Russian oil exports. The disruption in unloading processes could lead to increased oil prices and affect global supply chains. Countries like India and China, major consumers of Russian oil, may face challenges in securing their energy needs, potentially leading to increased demand for oil from other sources. The sanctions also highlight the geopolitical tensions between the U.S. and Russia, with potential implications for international relations and trade policies. The forced sale of Lukoil's foreign assets and operational disruptions could have long-term effects on the company's global presence and financial stability.

What's Next?

With the November 21 deadline approaching, the situation is likely to escalate as companies and countries adjust to the new sanctions. Traders expect that unsold Russian oil may be redirected to China, where it is being sold at significant discounts. The sanctions could lead to further shifts in global oil trade patterns, with Asian markets potentially absorbing more Russian crude. Additionally, the geopolitical landscape may see increased tensions as Russia seeks to mitigate the impact of U.S. sanctions on its economy and oil industry. Stakeholders, including political leaders and businesses, will need to navigate these changes and assess their strategies in response to the evolving situation.

Beyond the Headlines

The sanctions on Russian oil companies raise ethical and legal questions regarding the use of economic measures as a tool for political influence. The impact on global oil markets could lead to discussions about energy security and the need for diversified energy sources. The situation also underscores the interconnectedness of global economies and the potential ripple effects of geopolitical decisions on industries and societies worldwide. Long-term shifts in oil trade patterns may influence future energy policies and international relations.