What's Happening?

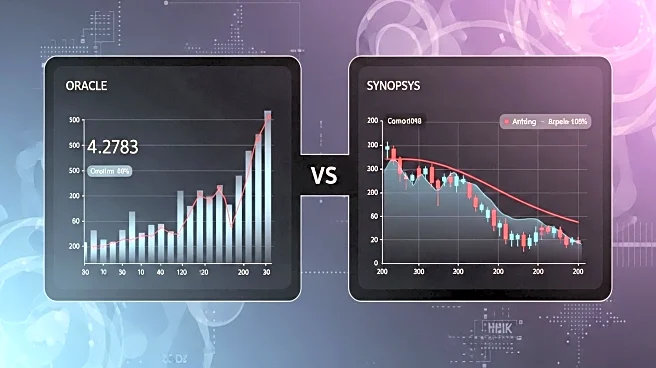

The S&P 500 saw a 0.3% increase on September 10, 2025, driven by Oracle's impressive growth forecast in its cloud infrastructure business, fueled by strong AI demand. Oracle's stock surged by 36%, marking the top performance in the S&P 500, despite fiscal first-quarter results falling short of expectations. This surge elevated Larry Ellison's net worth above Elon Musk's, making him the richest person globally. Conversely, Synopsys experienced a 36% drop in stock value after missing quarterly estimates and lowering its forecasts.

Why It's Important?

Oracle's stock surge highlights the growing importance of AI in driving business growth and investor interest. The company's optimistic outlook in cloud infrastructure suggests a shift towards AI-driven solutions, impacting tech industry dynamics. Synopsys' decline reflects challenges in the semiconductor design sector, emphasizing the competitive pressures and market volatility faced by tech companies. These developments could influence investment strategies and sector focus among stakeholders.

What's Next?

Oracle's continued focus on AI and cloud infrastructure may lead to further stock appreciation and industry influence. Investors and tech companies will likely watch Oracle's performance closely, as its success could set trends in AI adoption and cloud services. Synopsys may need to reassess its strategies to regain investor confidence and address market challenges.