What's Happening?

Tredegar Corporation reported its third-quarter 2025 financial results, showing a net income of $7.1 million from continuing operations, a turnaround from a loss of $3.4 million in the same quarter of 2024.

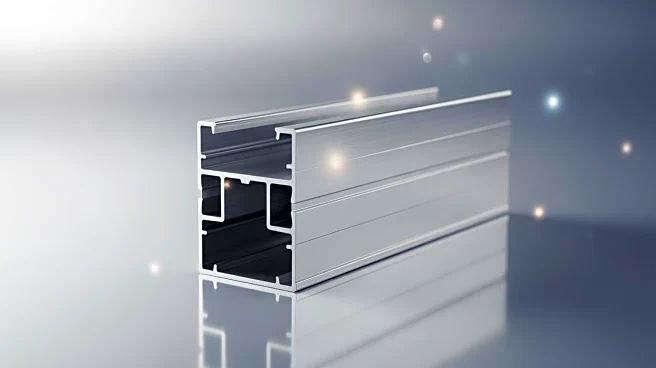

The Aluminum Extrusions segment achieved an EBITDA of $16.8 million, significantly higher than the $6.2 million reported in the previous year. Sales volume for this segment increased to 41.3 million pounds, marking a 19.5% rise year-over-year. Despite a 5% decrease in net new orders, open orders at the quarter's end were up compared to the previous year. The PE Films segment also reported growth, with an EBITDA of $7.2 million, up from $5.9 million in the third quarter of 2024.

Why It's Important?

Tredegar's financial performance underscores its resilience and ability to capitalize on market opportunities despite tariff challenges. The growth in EBITDA and sales volume for Aluminum Extrusions indicates strong demand and operational improvements. The reduction in net debt from $54.8 million to $36.2 million enhances Tredegar's financial stability, potentially benefiting shareholders. The company's strategic focus on cost reduction and efficiency improvements is expected to drive future growth and profitability, making it a key player in the industrial manufacturing sector.

What's Next?

Tredegar is set to explore cost reduction strategies to enhance shareholder value, with expected benefits starting in 2026. The company will continue to assess the impact of tariffs and adjust its business strategies accordingly. Stakeholders can expect further updates on Tredegar's strategic initiatives and financial performance in the coming quarters, as the company aims to maintain its growth trajectory.

Beyond the Headlines

The increase in Section 232 tariffs to 50% has not led to the expected market share shift to U.S. aluminum producers, presenting challenges in trade policy impacts. Tredegar's ability to adapt to these changes and maintain competitive pricing will be crucial for long-term sustainability. The company's focus on innovation and market expansion, particularly in the specialty products segment, could drive future growth.