What's Happening?

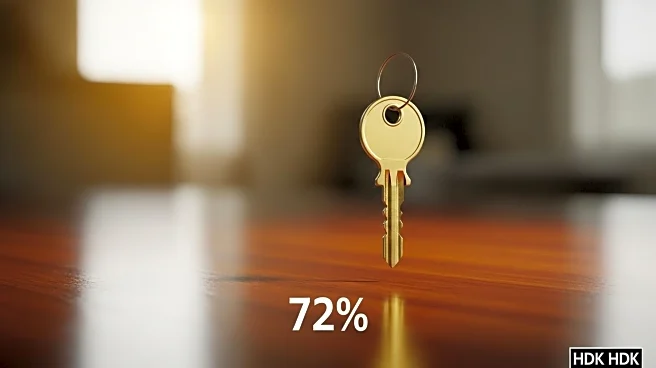

A recent report from Realtor.com highlights a significant housing affordability crisis in the United States, revealing that the average household can afford only 28% of homes currently on the market. This situation is attributed to a combination of factors, including higher mortgage rates and stagnant income growth. Since 2019, mortgage rates have increased from an average of 3.5%-4.5% to 6.5%-7%, significantly raising monthly payments. Meanwhile, real household income has remained relatively unchanged, failing to offset the increased costs. Additionally, home prices have surged by nearly 38% since 2019, further exacerbating the affordability issue.

Why It's Important?

The housing affordability crisis has profound implications for the U.S. economy and society. As more households find themselves unable to purchase homes, the dream of homeownership becomes increasingly elusive, impacting financial stability and wealth accumulation. The crisis may lead to increased demand for rental properties, driving up rental prices and contributing to housing insecurity. Policymakers and industry stakeholders must address these challenges to ensure equitable access to housing and prevent long-term economic disparities.

Beyond the Headlines

The affordability crisis raises ethical and social concerns about access to housing and the widening gap between income levels and housing costs. It underscores the need for comprehensive policy solutions that address both supply and demand factors in the housing market. Long-term shifts may include changes in urban planning, increased investment in affordable housing, and innovative financing solutions to support homebuyers. The crisis also highlights the importance of addressing income inequality and ensuring sustainable economic growth.