What's Happening?

BKM Wealth Management LLC has increased its holdings in Taiwan Semiconductor Manufacturing Company Ltd. (TSM) by 24.9% during the second quarter, as reported in their latest SEC filing. The firm now owns 4,941 shares, valued at approximately $1,119,000.

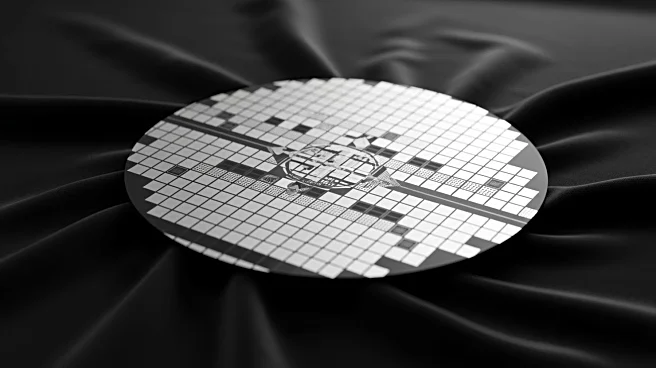

This move is part of a broader trend among institutional investors, with several firms, including 1248 Management LLC and Graybill Wealth Management LTD., also acquiring new positions in TSM earlier this year. Taiwan Semiconductor Manufacturing, a leading player in the semiconductor industry, reported a significant increase in quarterly earnings, with a net margin of 43.72% and a return on equity of 36.06%. The company's revenue for the quarter was $32.36 billion, marking a 40.1% increase from the previous year. Additionally, TSM has announced an increase in its quarterly dividend, reflecting its strong financial performance.

Why It's Important?

The increased investment by BKM Wealth Management and other institutional investors in Taiwan Semiconductor Manufacturing underscores the growing confidence in the semiconductor sector, which is crucial for various industries, including technology and automotive. TSM's robust financial performance and strategic dividend increase highlight its resilience and potential for growth, making it an attractive option for investors. The semiconductor industry is pivotal to the U.S. economy, influencing technological advancements and supply chain dynamics. As TSM continues to expand its market presence, it could drive innovation and competitiveness in the U.S. tech sector, benefiting stakeholders ranging from tech companies to consumers.

What's Next?

Taiwan Semiconductor Manufacturing's positive earnings report and increased dividend are likely to attract further interest from investors. Analysts have raised their price targets for TSM, with some predicting significant growth potential. As the company continues to innovate and expand its production capabilities, it may play a critical role in addressing global semiconductor shortages. Stakeholders will be closely monitoring TSM's strategic moves and market performance, as these could have broader implications for the semiconductor industry and related sectors.