What's Happening?

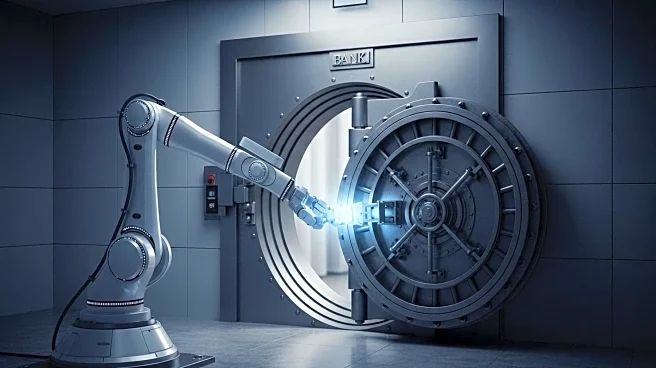

Lloyds Banking Group has undertaken significant workforce restructuring as part of a £3 billion transformation plan aimed at enhancing cost efficiency and long-term profitability. The bank has closed 136 branches and eliminated over 3,000 roles, while investing heavily in AI-driven tools like its Athena platform, which has reduced customer service resolution times by 66%. These efforts have resulted in £1.5 billion in cost savings since 2021 and a cost-to-income ratio below 50% in 2025. Despite these gains, the industry is closely monitoring whether such strategies can maintain profitability without compromising customer trust or employee morale.

Why It's Important?

Lloyds' restructuring reflects broader trends in the financial services sector, where institutions are increasingly relying on automation and digital platforms to reduce costs and improve efficiency. The bank's focus on AI and digital tools has bolstered its non-banking segments, such as insurance and pensions, which saw a 21% profit increase in 2025. However, the decline in Q1 2025 profits due to higher impairment charges highlights the risks associated with aggressive cost-cutting strategies. The restructuring efforts raise concerns about accessibility for older and disabled customers, as well as the potential erosion of institutional knowledge and employee morale.

What's Next?

The financial services sector is expected to continue downsizing, driven by high interest rates, regulatory pressures, and the need to reinvest in AI. Lloyds and other institutions must carefully manage workforce transitions and regulatory compliance to ensure long-term profitability. Investors will need to weigh the trade-offs between short-term savings and innovation, as the sector navigates the challenges of automation and offshoring.