What's Happening?

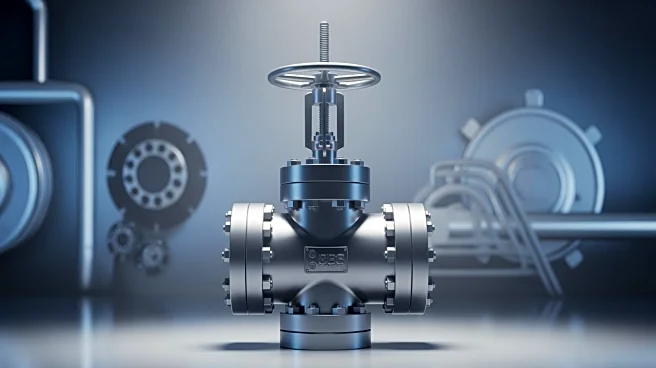

Williams Companies, a major U.S. pipeline operator, reported third-quarter profits that fell short of Wall Street expectations. The company's adjusted profit was 49 cents per share, below the analysts'

estimate of 56 cents per share. The shortfall was attributed to increased interest and maintenance costs, which offset gains from higher service revenues. Despite the profit miss, service revenues rose to $2.12 billion from $1.91 billion the previous year. The company also announced an increase in its 2025 growth capital expenditure by $500 million, following a significant investment in Woodside Energy's Louisiana LNG project.

Why It's Important?

The financial performance of Williams Companies is crucial for stakeholders in the energy sector, as it reflects the challenges and opportunities within the industry. The rise in expenses highlights the cost pressures faced by pipeline operators, which can impact profitability and investment decisions. The company's decision to increase capital expenditure indicates a commitment to growth and expansion, which could have long-term benefits. However, the profit miss may affect investor confidence and lead to scrutiny of the company's cost management strategies.