What's Happening?

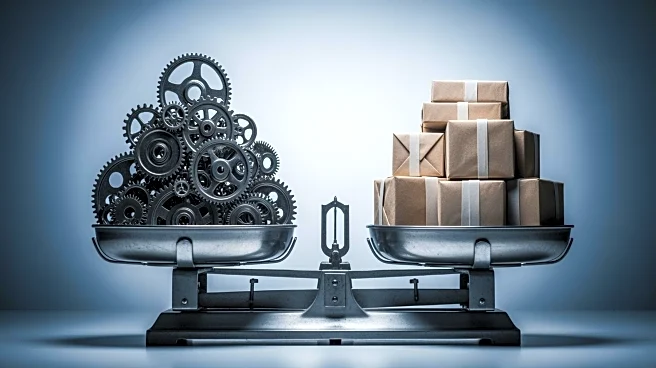

Following a record-setting week on Wall Street, certain stocks are showing signs of being overbought, which could lead to potential declines. The S&P 500 reached a new all-time high, driven by optimism over possible interest rate cuts from the Federal Reserve after a disappointing August jobs report. However, this enthusiasm quickly turned to concern, causing the index to end the day with losses. Despite this, the S&P 500 managed a modest weekly gain. Analysis from CNBC Pro, using data from LSEG, identified stocks with a 14-day relative strength index (RSI) above 70 as overbought. Notable among these is Alphabet, which saw a 9% surge in shares, raising its RSI to 84.1, following a favorable antitrust ruling. Other overbought stocks include Seagate Technology and Western Digital, both experiencing significant share price increases. Conversely, Dollar Tree is categorized as oversold, with its shares dropping over 8% due to disappointing annual guidance.

Why It's Important?

The identification of overbought stocks is crucial for investors as it signals potential market corrections. Stocks with high RSI values may face downward pressure, impacting investment strategies and market dynamics. Alphabet's significant market cap increase highlights the influence of legal rulings on stock performance. Meanwhile, the contrasting fortunes of Seagate and Western Digital versus Dollar Tree underscore the varied impacts of market sentiment and company guidance on stock valuations. These developments could affect investor confidence and trading strategies, influencing broader market trends.

What's Next?

As market participants reassess their strategies, the dynamics between overbought and oversold stocks will likely shape upcoming trading sessions. Investors may need to consider potential corrections in overbought stocks and opportunities in oversold ones. The Federal Reserve's future interest rate decisions and economic indicators will also play a critical role in market movements. Stakeholders will be closely monitoring these factors to adjust their portfolios accordingly.