What's Happening?

Indonesian miners have ceased spot coal exports following a government proposal to significantly reduce production quotas. The proposed cuts, which range from 40% to 70% below 2025 levels, aim to decrease overall production by nearly a quarter to boost

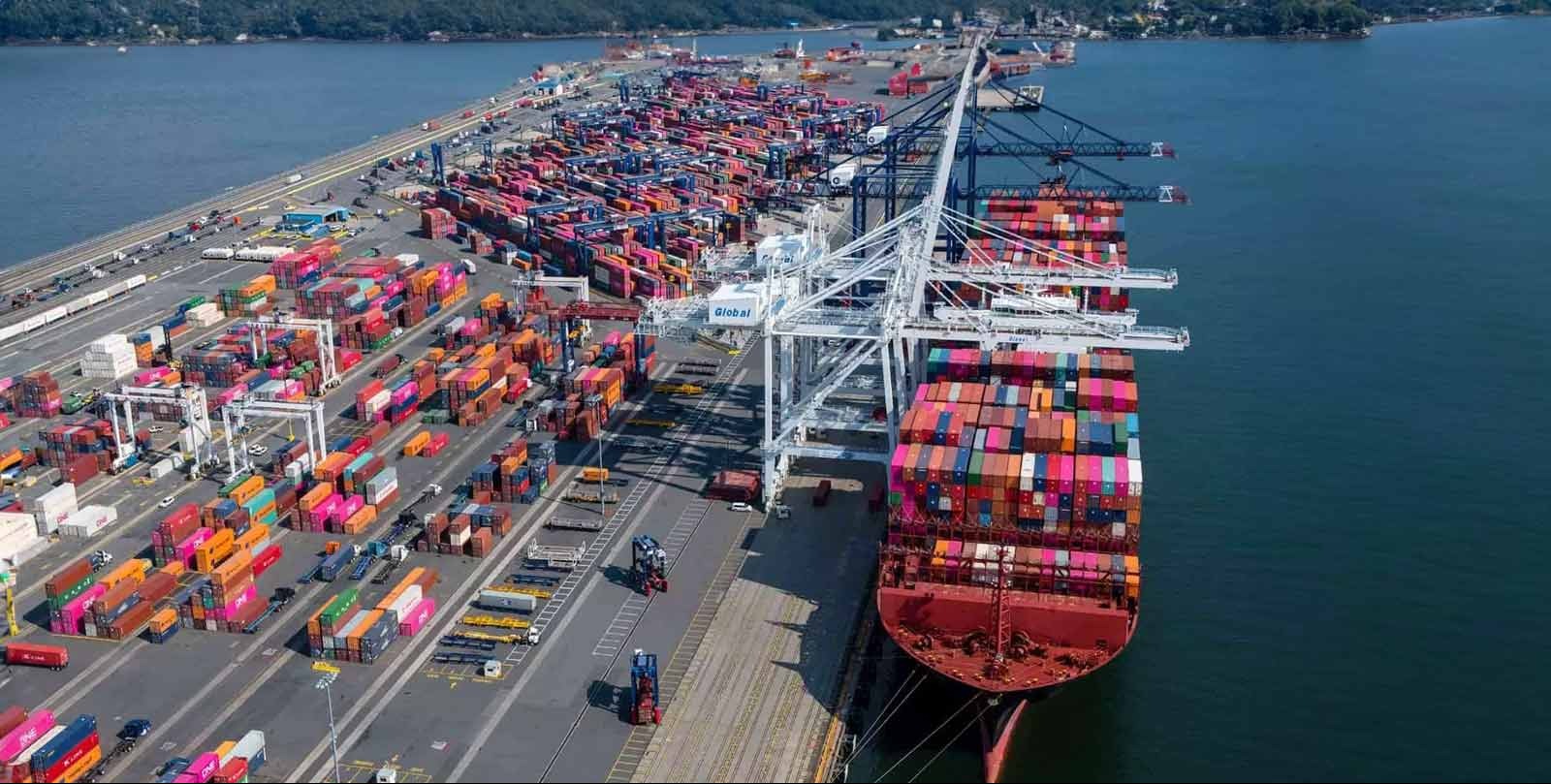

coal prices. This decision has left Asian buyers, particularly in China and India, struggling to secure coal supplies from Indonesia, the world's largest coal exporter. The Indonesian Coal Mining Association has expressed opposition to the government's plan, citing potential layoffs and mine closures. While long-term contracts are still being honored, some miners are contemplating cancellations due to unforeseen circumstances. The proposal is part of Indonesia's strategy to increase government revenues amid declining demand from major buyers. In 2025, Indonesia accounted for half of the global electricity-grade coal exports, and the proposed cuts could reduce production to about 600 million tons.

Why It's Important?

The halt in spot coal exports from Indonesia is likely to have significant implications for global coal markets, particularly in Asia. As Indonesia is a major supplier, the proposed production cuts could lead to increased coal prices and tighter supply, affecting energy costs and availability in countries reliant on Indonesian coal. The move could also impact the financial stability of Indonesian mining companies and lead to job losses within the industry. Additionally, the potential for increased coal prices may prompt buyers to seek alternative suppliers, such as Russia, South Africa, and Mozambique, which could shift trade dynamics in the global coal market. The situation underscores the vulnerability of energy markets to policy changes and the importance of diversifying energy sources.

What's Next?

The Indonesian government has yet to make a final decision on the proposed production cuts, and the outcome will likely influence the resumption of spot coal exports. If the cuts are implemented, coal prices are expected to rise, potentially leading to increased energy costs for importing countries. Industry stakeholders, including miners and buyers, may lobby for policy adjustments to mitigate economic impacts. Additionally, countries dependent on Indonesian coal may accelerate efforts to diversify their energy imports to ensure stable supply. The situation will require close monitoring by energy market participants and policymakers to adapt to potential disruptions.