What's Happening?

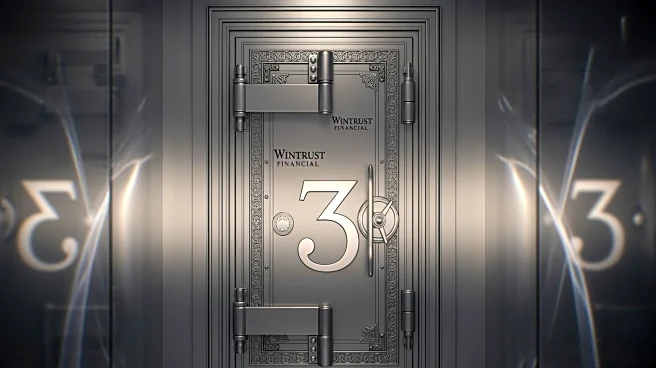

Wintrust Financial, a bank based in Rosemont, Illinois, has become the third largest bank in the Chicago area by deposits, according to recent data from the Federal Deposit Insurance Corp. This marks the first

time in over two decades that a locally based bank has ranked among the top three in the city. Wintrust's rise comes after a period of consolidation in the banking industry, where many local banks were acquired by out-of-town institutions. With $49.5 billion in local deposits, Wintrust now holds 8.6% of the market, trailing only JPMorgan Chase and BMO. The bank's growth is attributed to its strategic focus on community banking and its ability to capitalize on market disruptions.

Why It's Important?

The emergence of Wintrust as a major player in Chicago's banking scene is significant for several reasons. It highlights a shift towards local banking in a market that has seen significant consolidation by larger, out-of-town banks. This development is particularly important for the local economy, which is characterized by a diverse array of midsize, often family-owned businesses that rely heavily on local banks for financing. Wintrust's success underscores the value of having decision-makers who are local and accessible, which can be a competitive advantage in a fragmented market like Chicago. The bank's growth also reflects a broader trend of community banks playing a crucial role in serving markets that larger banks may overlook.

What's Next?

Wintrust's CEO, Tim Crane, has expressed pride in the bank's achievement and indicated that there is still significant market share to capture. As Wintrust continues to expand its presence in the Midwest, it may face increased competition from larger banks looking to strengthen their foothold in the region. However, Wintrust's focus on community banking and maintaining a high-touch approach could help it sustain its growth. The bank's future strategies will likely involve balancing expansion with maintaining its local roots, which could influence its ability to compete with national banking giants.

Beyond the Headlines

Wintrust's rise as a top bank in Chicago also has cultural and symbolic implications. It represents a resurgence of local pride and the importance of having homegrown institutions that are relevant both locally and within the broader banking industry. This development may inspire other local businesses to pursue growth and expansion, contributing to the economic vitality of the region. Additionally, Wintrust's success could encourage other community banks to adopt similar strategies, potentially leading to a more competitive and diverse banking landscape.