What's Happening?

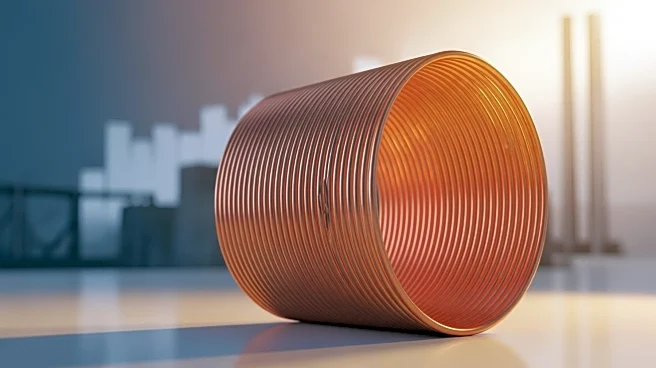

Copper prices have increased following the release of positive economic data from China, the world's largest consumer of the metal. The data indicated easing deflationary pressures, with consumer prices turning

positive and factory-gate price declines narrowing. This has lifted confidence in China's economic recovery, supporting copper demand. The U.S. Senate's progress on a bill to fund the government has also contributed to market optimism, removing a drag on sentiments.

Why It's Important?

The rise in copper prices is significant as it reflects broader market confidence in economic recovery and growth prospects. Copper is a key industrial metal, and its demand is closely tied to economic activity. Positive data from China suggests potential stability in global markets, influencing commodity prices and investment strategies. The situation underscores the importance of economic indicators in shaping market dynamics and investor sentiment.

What's Next?

Analysts will continue to monitor economic data from China and other major economies for signs of sustained recovery. The U.S. Senate's actions on government funding will be closely watched for potential impacts on market confidence. Copper demand from end-users remains resilient, and purchasing orders may increase as prices stabilize. The market will assess the effectiveness of policies aimed at spurring demand and supporting economic growth.