What's Happening?

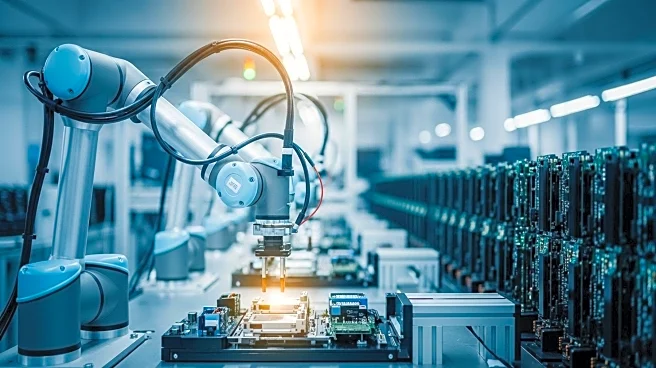

The Trump administration is contemplating imposing tariffs on foreign electronic devices based on the number of chips they contain. This move aims to encourage companies to shift their manufacturing operations to the United States. The proposed tariffs would be calculated as a percentage of the estimated value of the product's chip content. This plan is part of a broader strategy to reshore critical manufacturing to the U.S., which includes tariffs, tax cuts, deregulation, and energy abundance. The administration has already announced new import tariffs, including 100% duties on branded drugs and 25% levies on heavy-duty trucks. The potential tariffs could affect a wide range of consumer products, potentially increasing inflation.

Why It's Important?

The proposed tariffs could significantly impact the U.S. economy by increasing the cost of consumer goods, which may exacerbate existing inflationary pressures. The plan could also affect international trade relations, particularly with major non-U.S. chipmakers like Taiwan Semiconductor Manufacturing Co and Samsung Electronics. Domestically, the tariffs could drive up the cost of production for U.S. manufacturers who rely on imported components, potentially leading to higher prices for consumers. The move underscores the administration's focus on reducing reliance on foreign imports for semiconductor products, which are deemed essential for national and economic security.

What's Next?

If the tariffs are implemented, companies may need to reassess their supply chains and consider relocating manufacturing operations to the U.S. to avoid the additional costs. The Commerce Department is considering a 25% tariff rate for chip-related content in imported devices, with potential exemptions for companies investing in U.S.-based manufacturing. The administration's approach may face legal challenges and pushback from affected industries and trade partners. The outcome of these tariffs could influence future U.S. trade policies and manufacturing strategies.