What's Happening?

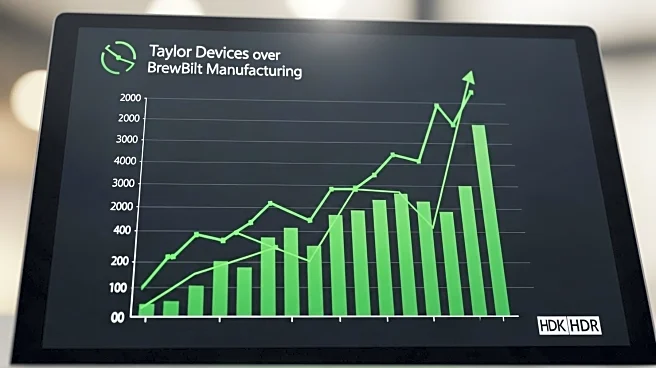

Taylor Devices and BrewBilt Manufacturing are both small-cap industrial companies, but Taylor Devices has shown stronger financial performance and market stability. Taylor Devices, listed on NASDAQ, has higher revenue and earnings compared to BrewBilt Manufacturing, which is listed on OTCMKTS. Taylor Devices specializes in shock absorption and energy storage devices, primarily for aerospace and defense industries. Analysts favor Taylor Devices due to its profitability and institutional ownership, indicating potential for long-term growth. BrewBilt Manufacturing focuses on brewing systems for the craft beer industry but faces challenges in financial performance and market volatility.

Why It's Important?

Taylor Devices' strong financial metrics and analyst ratings highlight its market stability and growth potential. The company's focus on aerospace and defense applications positions it as a key player in these sectors. Institutional investors' confidence in Taylor Devices suggests stability and potential for long-term returns. In contrast, BrewBilt Manufacturing's limited financial data and higher market volatility indicate challenges in gaining investor confidence. Taylor Devices' performance could influence investment decisions in the industrial sector, impacting stakeholders and market dynamics.