What is the story about?

What's Happening?

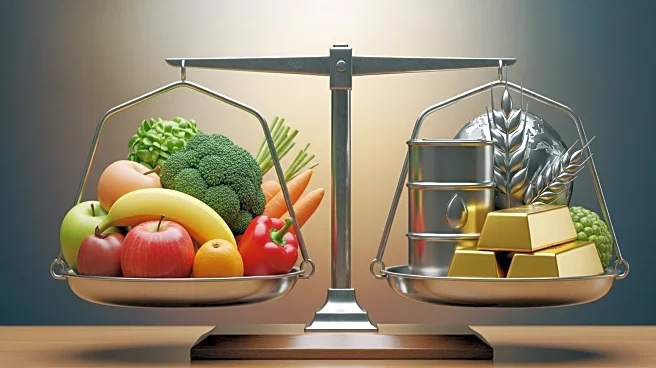

The Food and Agriculture Organization (FAO) of the United Nations has released its latest report indicating that the FAO Food Price Index remained largely unchanged in August. The index, which tracks monthly changes in international prices of globally-traded food commodities, averaged 130.1 points, slightly up from July's revised level of 130.0 points. This marks a 6.9 percent increase compared to the previous year. The report highlights fluctuations in various commodity prices, with increases in meat, sugar, and vegetable oil prices offsetting declines in cereal and dairy prices. Notably, the FAO Vegetable Oil Price Index rose by 1.4 percent, driven by Indonesia's plans to increase its biodiesel blending mandate. Meanwhile, the FAO Cereal Price Index saw a 0.8 percent decline, influenced by larger wheat harvests in the European Union and Russia, while maize prices rose due to increased demand in the United States.

Why It's Important?

The stability in the FAO Food Price Index is significant as it reflects the balance between supply and demand in global food markets. The increase in vegetable oil prices, particularly palm, sunflower, and rapeseed oils, could impact biodiesel production and food manufacturing industries. Conversely, the decline in cereal prices, especially wheat, may benefit consumers and industries reliant on these commodities. The report's insights into meat and sugar prices also highlight the ongoing demand dynamics in major markets like the United States and China. These trends are crucial for policymakers and businesses as they navigate the complexities of global food supply chains and address food security challenges.

What's Next?

Looking ahead, the FAO forecasts a record high in global cereal production for 2025, with significant increases in maize output expected from Brazil and the United States. This could lead to a comfortable supply outlook globally, with cereal stocks projected to expand by 3.7 percent by the end of 2026. The anticipated growth in cereal trade, supported by abundant exportable supplies and strong demand from countries like China and Pakistan, suggests potential shifts in international trade dynamics. Additionally, the rising prices of nitrogen fertilizers, as noted by the Agricultural Market Information System (AMIS), could affect application rates and crop yields, posing challenges for agricultural producers.

Beyond the Headlines

The FAO's report underscores the interconnectedness of global agricultural markets and the influence of geopolitical and environmental factors on food prices. The fluctuations in commodity prices may prompt discussions on sustainable agricultural practices and the need for resilient food systems. The report also highlights the importance of monitoring fertilizer affordability, which could impact long-term agricultural productivity and food security. As countries strive to balance economic growth with environmental sustainability, these insights could inform policy decisions and strategic investments in the agricultural sector.