What is the story about?

What's Happening?

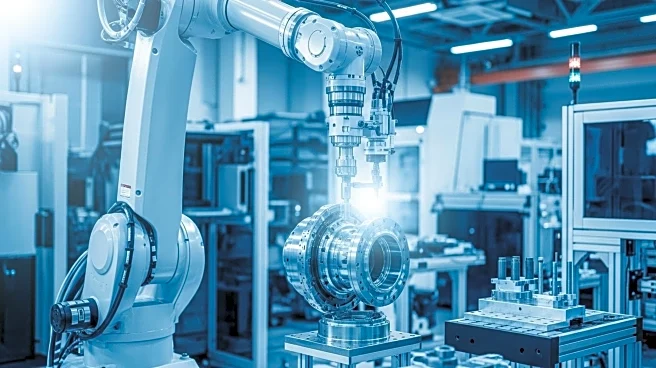

The One Big Beautiful Bill Act (OBBBA), enacted in July 2025, introduces significant tax reforms aimed at boosting domestic investment in tangible production within the United States. The act revives and makes permanent 100 percent bonus depreciation for short-lived investments, repeals the five-year amortization of domestic research and development expenses in favor of immediate expensing, and establishes a new 100 percent deduction for structures related to tangible production. These changes are designed to reduce tax liabilities for C corporations, with the manufacturing sector receiving the largest nominal reduction in tax liability over the 2025-2035 budget window.

Why It's Important?

The tax reforms under the OBBBA are crucial for stimulating economic growth and enhancing the competitiveness of U.S. manufacturing. By reducing tax liabilities and encouraging investment in tangible production, the act aims to strengthen the manufacturing sector, which is a key driver of economic activity and job creation. The reforms also impact other sectors, such as information and finance, by lowering tax burdens and promoting investment. These changes are expected to increase long-term investment and economic growth, benefiting industries involved in tangible production.

What's Next?

As the OBBBA's provisions take effect, corporations in manufacturing and other sectors will likely adjust their investment strategies to capitalize on the tax benefits. The focus will be on maximizing the advantages of immediate expensing and bonus depreciation to enhance production capabilities. Policymakers and industry leaders may monitor the impact of these reforms on economic growth and job creation, potentially leading to further adjustments in tax policy to support domestic industries.

Beyond the Headlines

The OBBBA's tax reforms may lead to broader shifts in corporate investment behavior, emphasizing tangible production and innovation. Ethical considerations regarding the distribution of tax benefits across industries may arise, prompting discussions on equitable tax policy. The act's focus on manufacturing could influence cultural perceptions of the sector's role in the U.S. economy, highlighting its importance in driving technological advancements and sustainable growth.