What's Happening?

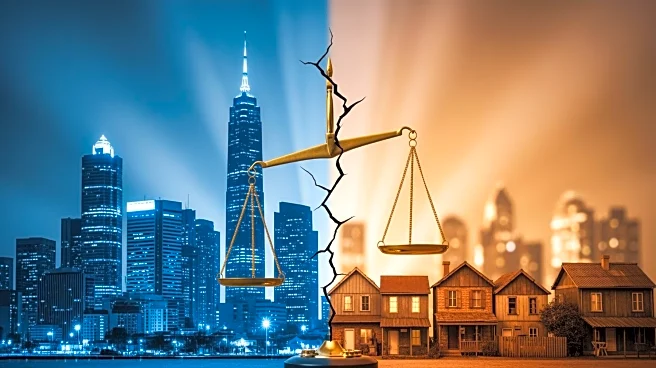

A recent study by UC Irvine PhD student Schuyler Louie and San Francisco Fed researchers challenges the traditional view that increasing housing supply is the primary solution to the housing affordability crisis. The research indicates that average income

growth is more closely related to house price growth than to housing supply growth. The study found that housing supply growth is more strongly linked to population growth rather than income growth. This suggests that the affordability crisis is more about income inequality, with higher earners driving up home prices. The researchers argue that regulatory reforms may have limited impact on affordability and that the focus should be on understanding changes in the labor market and economic growth distribution.

Why It's Important?

The findings of this study have significant implications for policymakers and urban planners. By highlighting income inequality as a major factor in housing affordability, the research suggests that efforts to address the crisis should focus on economic policies that promote equitable income growth. This could involve measures to increase wages for middle and lower-income earners or policies that address the distribution of economic growth. The study challenges the effectiveness of current strategies that emphasize increasing housing supply and suggests a need for a broader approach that considers economic and labor market dynamics.

What's Next?

The study's conclusions may prompt a reevaluation of housing policies at both state and federal levels. Policymakers might consider integrating economic reforms aimed at reducing income inequality into housing strategies. This could involve collaborations between housing authorities and economic development agencies to create comprehensive plans that address both housing supply and income distribution. Additionally, the research may influence future studies and discussions on housing affordability, encouraging a shift in focus towards economic factors.