What's Happening?

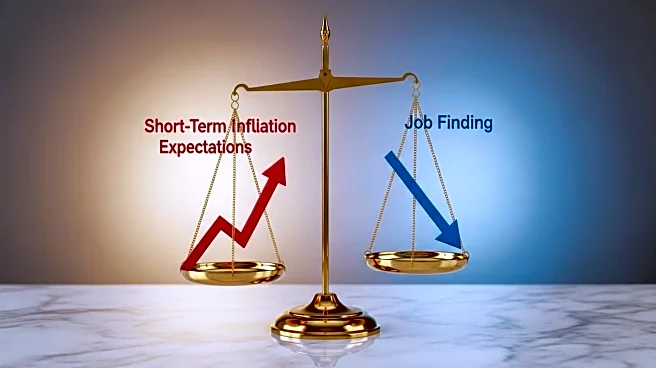

The Federal Reserve Bank of New York has released its August 2025 Survey of Consumer Expectations, revealing a slight increase in short-term inflation expectations among households. The survey indicates that median inflation expectations rose by 0.1 percentage point to 3.2% for the one-year-ahead horizon, while remaining stable at 3.0% for the three-year and 2.9% for the five-year horizons. Additionally, the survey highlights a significant decline in job finding expectations, marking the lowest level since the series began in June 2013. The perceived probability of finding a job if one's current employment is lost fell by 5.8 percentage points to 44.9%. The survey also notes unchanged expectations for household income growth and spending, with median household spending growth expectations slightly increasing to 5.0%.

Why It's Important?

The findings from the Federal Reserve Bank of New York's survey are crucial as they reflect consumer sentiment regarding inflation and employment, which are key indicators of economic health. The increase in short-term inflation expectations suggests that consumers anticipate higher prices in the near future, potentially influencing spending and saving behaviors. The decline in job finding expectations could signal concerns about labor market conditions, affecting consumer confidence and economic stability. These insights are vital for policymakers and economists as they assess the need for adjustments in monetary policy to address inflationary pressures and support employment.

What's Next?

The survey results may prompt discussions among policymakers at the Federal Reserve regarding potential adjustments to interest rates or other monetary policy tools to manage inflation expectations and support the labor market. Economic stakeholders, including businesses and investors, will likely monitor these developments closely, as changes in consumer expectations can impact market dynamics and investment strategies. Additionally, the broader economic implications of these findings may influence legislative priorities and government initiatives aimed at bolstering economic growth and stability.

Beyond the Headlines

The survey's insights into consumer expectations also highlight the importance of understanding demographic variations in economic perceptions. The pronounced decline in job finding expectations among those with at most a high school education underscores the need for targeted workforce development and educational programs to enhance job prospects for vulnerable groups. Furthermore, the survey's findings on credit access and financial situations may inform discussions on financial inclusion and the need for policies that support equitable access to economic opportunities.