What's Happening?

Canada's oil sands are experiencing a resurgence, with crude output reaching new highs and shares of major producers like Imperial Oil Ltd., Suncor Energy Inc., Cenovus Energy Inc., and MEG Energy Corp.

soaring. This growth is largely attributed to the newly expanded Trans Mountain oil pipeline, which has alleviated previous capacity constraints and increased access to the Asian market. As a result, production is expected to grow by 300,000 to 400,000 barrels per day, reaching 6 million daily barrels by 2030. The expansion has also improved local prices for heavy oil, narrowing the discount to the U.S. benchmark from $30 or more to $10-$12 per barrel.

Why It's Important?

The resurgence of Canada's oil sands marks a significant shift in the oil market landscape, particularly as U.S. shale production peaks. This shift is drawing increased interest from U.S. institutional investors, whose stake in oil sands companies has risen from 40% to 65% over the past decade. The oil sands offer a cost advantage due to their slower production decline rate compared to U.S. shale, which requires continuous drilling to maintain output levels. This efficiency and cost-effectiveness make Canadian oil sands producers some of the lowest-cost large-cap oil companies in North America.

What's Next?

As U.S. shale production plateaus, investors are likely to continue shifting their focus to Canadian oil sands, which promise steady crude supplies for decades. The industry is expected to benefit from ongoing investments in infrastructure and technology to maintain and potentially increase production levels. Additionally, the improved pricing environment may encourage further consolidation and efficiency improvements among Canadian producers, potentially leading to more competitive positioning in the global oil market.

Beyond the Headlines

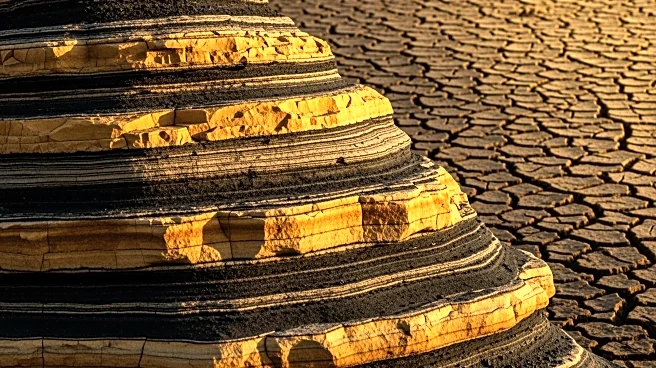

The shift towards Canadian oil sands could have broader implications for global energy markets, particularly in terms of sustainability and environmental impact. While oil sands production is more stable, it also raises concerns about carbon emissions and environmental degradation. As the industry grows, there may be increased pressure to adopt cleaner technologies and practices to mitigate these impacts, potentially influencing regulatory policies and investment strategies.