What's Happening?

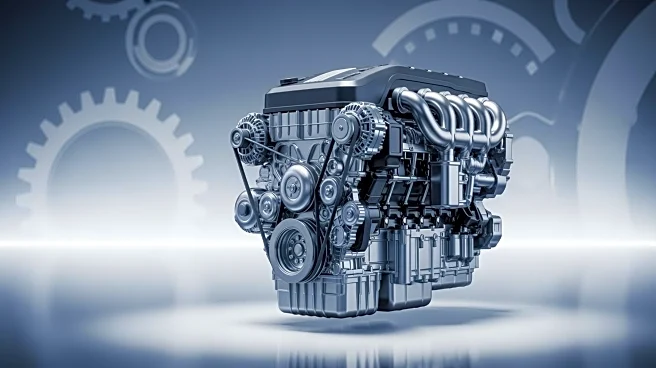

Paccar, a leading truck manufacturer, reported a net income of $590 million for the third quarter of 2025, despite a decline in revenue compared to the same period in 2024. The company's revenue for the quarter was $6.67 billion, down from $8.24 billion the previous

year. Global truck deliveries also decreased, with 31,900 units delivered compared to 44,900 units in 2024. Paccar's financial services and parts divisions performed well, contributing to the company's profitability. The company is investing in capital projects and research and development, with plans for a new battery factory in Mississippi.

Why It's Important?

Paccar's ability to maintain profitability despite declining revenues highlights its operational efficiency and strong market position. The company's investments in technology and infrastructure, such as the battery factory, indicate a focus on future growth and innovation. This strategic approach may enhance Paccar's competitiveness in the evolving automotive industry, particularly in the hybrid and electric vehicle segments. The company's performance could influence investor confidence and impact stock market perceptions.

What's Next?

Paccar's projections for truck sales in the U.S., Canada, and Europe suggest potential growth in these markets. The upcoming Section 232 truck tariffs may affect market dynamics, and Paccar's production strategy could adapt to these changes. The company's continued investment in research and development may lead to new product offerings and technological advancements, positioning Paccar as a leader in sustainable transportation solutions.