What is the story about?

What's Happening?

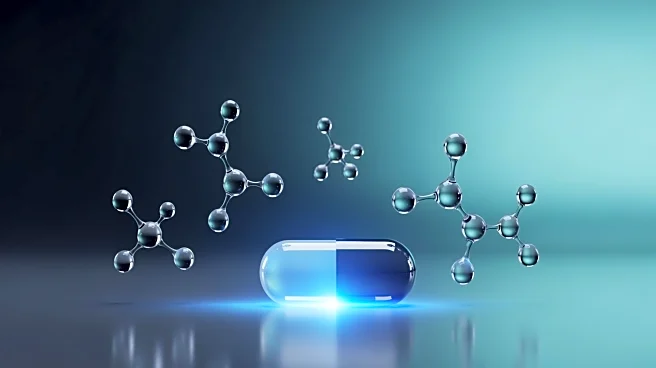

Nvidia's CFO, Collette Kress, discussed the company's ongoing efforts to ship its H20 AI GPUs to China, highlighting a potential $2 billion to $5 billion revenue opportunity. Despite receiving license approvals for key customers in China, Nvidia faces geopolitical challenges that need resolution before the GPUs can be shipped. Chinese tech firms, including ByteDance, are awaiting their orders, while Chinese data centers have been instructed to source at least 50% of their chips domestically. Nvidia has reportedly suspended production of the H20 chip due to security concerns raised by Chinese officials.

Why It's Important?

The situation underscores the complexities of international trade and technology transfer amid geopolitical tensions. Nvidia's potential revenue from the deal highlights the significant economic stakes involved, impacting both the company's financial outlook and broader industry dynamics. The geopolitical challenges reflect ongoing trade tensions between the U.S. and China, which could affect global supply chains and technology markets. The resolution of these issues is crucial for Nvidia's strategic positioning and could influence future trade policies and international relations.

What's Next?

Nvidia is likely to engage in diplomatic efforts with both U.S. and Chinese governments to resolve the geopolitical situation and secure the shipment of its AI GPUs. The company may also explore alternative strategies to mitigate risks and capitalize on the revenue opportunity. Stakeholders will be watching closely for developments, as the outcome could set precedents for future technology trade agreements. The resolution of these challenges could impact Nvidia's market position and influence broader industry trends.