What's Happening?

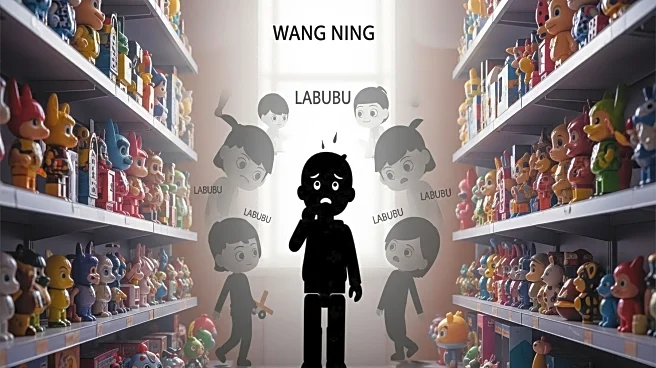

Wang Ning, the founder of Pop Mart, has experienced a significant financial setback as the market value of his company has plummeted. Once wealthier than tech investor Peter Thiel, Wang's net worth has decreased by $6 billion due to a decline in the popularity of Labubu, a rabbit-eared plush toy that had previously driven Pop Mart's success. The company's stock has dropped by 20% since its peak in late August, erasing $13 billion in market capitalization. This downturn follows a downgrade by JPMorgan, which cited concerns over the company's valuation and reliance on a single product.

Why It's Important?

The decline in Pop Mart's stock highlights the volatility and risks associated with businesses heavily reliant on fads and trends. The company's rapid growth was fueled by the popularity of Labubu, but as interest wanes, the financial repercussions are significant. This situation underscores the challenges faced by companies in maintaining long-term growth and stability when their success is tied to a single product. Investors and market analysts are likely to scrutinize Pop Mart's future strategies and diversification efforts to mitigate such risks.

What's Next?

Pop Mart is attempting to expand its market presence by opening more stores and vending machines internationally, aiming for overseas markets to contribute significantly to its earnings by 2027. The company is also exploring new product lines and collaborations to sustain its growth. However, maintaining cultural relevance and consumer interest in a rapidly changing market remains a challenge. The company's ability to innovate and adapt will be crucial in determining its future success and stability.

Beyond the Headlines

The rise and fall of Labubu reflect broader trends in consumer behavior and the lifecycle of popular products. The rapid hype cycle, driven by social media and celebrity endorsements, can lead to quick saturation and decline. This case serves as a reminder of the importance of strategic planning and diversification for companies reliant on trend-driven products. It also highlights the impact of market perceptions and analyst ratings on a company's financial health.