What's Happening?

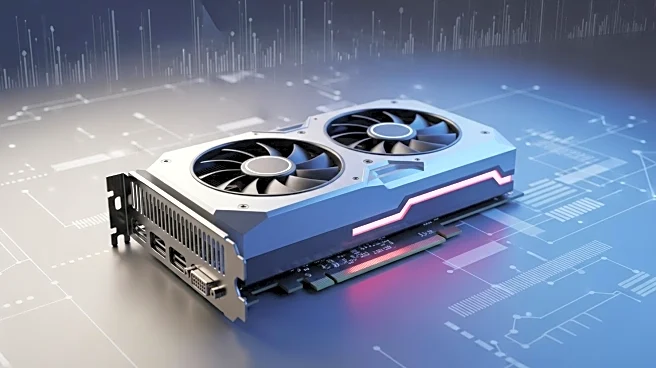

Nvidia is experiencing a significant market upswing, achieving a six-day winning streak with its stock price reaching new highs. The company's shares rose by approximately 1% to $189, marking its longest winning streak since June. This surge is part of a broader positive trend in the semiconductor sector, with the iShares Semiconductor ETF also seeing gains. Additionally, BlackRock received a positive endorsement from Bank of America, which anticipates substantial increases in the company's net flows for the third quarter. This optimism follows a challenging earnings report in July, where BlackRock missed revenue expectations.

Why It's Important?

Nvidia's continued success highlights the robust demand for semiconductor technology, driven by advancements in AI and computing. The company's performance is a bellwether for the tech-heavy Nasdaq, indicating investor confidence in the sector's growth potential. Meanwhile, BlackRock's anticipated recovery in net flows suggests a positive outlook for asset management firms, particularly those expanding into alternative assets. These developments are crucial for investors seeking opportunities in technology and financial markets, as they reflect broader economic trends and potential growth areas.

What's Next?

Investors will be closely monitoring Nvidia's performance to see if the winning streak continues, as well as any strategic moves by BlackRock to capitalize on growth in alternative assets. The upcoming announcement of Disney's CEO successor, expected early next year, will also be a focal point for market watchers, as it could influence the company's strategic direction and investor sentiment.