What is the story about?

What's Happening?

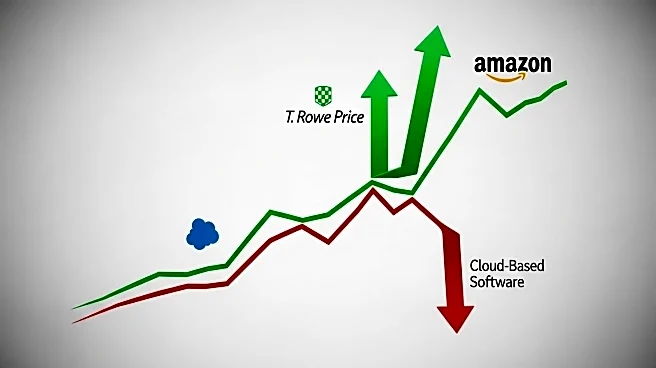

The S&P 500 index experienced a 0.8% increase on September 4, 2025, driven by a mix of corporate developments and economic indicators. T. Rowe Price shares surged following a new partnership with Goldman Sachs, which involves a significant stock purchase by Goldman. Amazon's stock also rose by 4.3% after JetBlue announced a partnership with Amazon's Project Kuiper to provide satellite internet services on flights. Conversely, Salesforce shares fell by 4.9% due to underwhelming guidance for its upcoming fiscal quarter, despite meeting sales and profit expectations for the previous quarter. The broader market gains were supported by a report indicating a slowdown in private-sector hiring, which investors interpreted as a potential precursor to Federal Reserve interest rate cuts.

Why It's Important?

The developments highlight the dynamic nature of the U.S. stock market, where corporate partnerships and strategic moves can significantly impact stock performance. T. Rowe Price's collaboration with Goldman Sachs could enhance its investment offerings, potentially attracting more clients. Amazon's expansion into satellite internet services through Project Kuiper positions it as a competitor to existing players like SpaceX's Starlink, potentially reshaping the in-flight internet market. Salesforce's cautious outlook reflects challenges in the tech sector, particularly in marketing and commerce product sales. These movements underscore the importance of strategic partnerships and market positioning in driving stock performance and investor confidence.

What's Next?

Investors will closely monitor the upcoming jobs report from the Bureau of Labor Statistics, which could influence Federal Reserve policy decisions. A continued slowdown in hiring might prompt the Fed to consider interest rate cuts, potentially boosting market sentiment. Companies like T. Rowe Price and Amazon may continue to benefit from strategic partnerships and expansions, while Salesforce will need to address its sales challenges to regain investor confidence. The evolving economic landscape and corporate strategies will play a crucial role in shaping future market trends.