What's Happening?

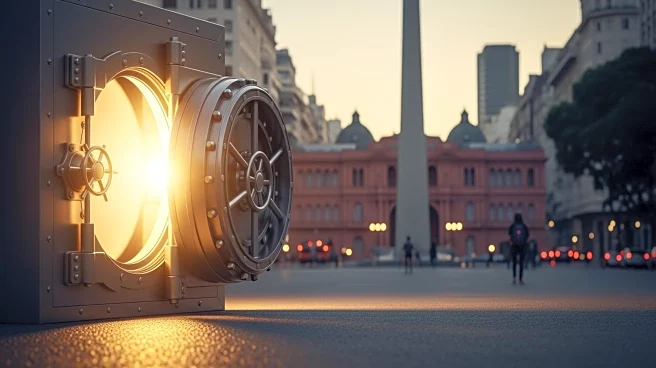

The Trump administration has announced an expansion of its financial assistance to Argentina, doubling the initial bailout package. Treasury Secretary Scott Bessent revealed that the United States is working

on a $20 billion facility in addition to the previously approved $20 billion credit swap line, bringing the total aid to $40 billion. This move aims to support Argentina's economy, which is facing significant challenges ahead of its midterm elections. The bailout is also expected to benefit major hedge funds, including BlackRock, Fidelity, and Pimco, which have ties to Bessent. The aid package is described as an 'economic Monroe Doctrine,' emphasizing the use of U.S. economic power over military intervention.

Why It's Important?

The expanded bailout package for Argentina highlights the Trump administration's strategic economic interventions in South America. By providing substantial financial support, the U.S. aims to stabilize Argentina's economy and maintain influence in the region. This move is particularly significant as Argentina has become China's top soybean supplier, impacting U.S. farmers due to Trump's tariff policies. The bailout also underscores the administration's approach to international economic relations, prioritizing private-sector solutions and benefiting major investment funds. Domestically, the U.S. government faces a shutdown over budget disagreements, with cuts affecting healthcare subsidies and Medicaid.

What's Next?

The upcoming midterm elections in Argentina will be crucial in determining the country's economic direction and the effectiveness of the bailout. If Argentine President Javier Milei retains power, he may continue pursuing cost-cutting measures supported by the Trump administration. Meanwhile, the U.S. government shutdown remains unresolved, with significant daily costs. The situation may prompt further discussions on budget allocations and international economic strategies. Stakeholders, including U.S. farmers and investment funds, will closely monitor developments in both Argentina and the U.S.

Beyond the Headlines

The bailout raises ethical questions about the influence of major hedge funds in international economic policies. The ties between Treasury Secretary Bessent and these funds may lead to scrutiny over potential conflicts of interest. Additionally, the reliance on economic power rather than military intervention reflects a shift in U.S. foreign policy strategies, with long-term implications for international relations and economic stability in the region.