Rapid Read • 8 min read

Pomerantz LLP has initiated an investigation into Dow Inc. concerning potential securities fraud and other unlawful business practices. The investigation follows Dow's recent financial report for the second quarter of 2025, which revealed a 7% year-over-year decline in net sales across all operating segments, totaling $10.1 billion. The company also announced adjustments to its dividend policy to maintain a balanced capital allocation framework. This news led to a significant drop in Dow's stock price, falling $5.30 per share, or 17.45%, closing at $25.07 on July 24, 2025. Pomerantz LLP, known for its expertise in securities class actions, is encouraging affected investors to join the class action.

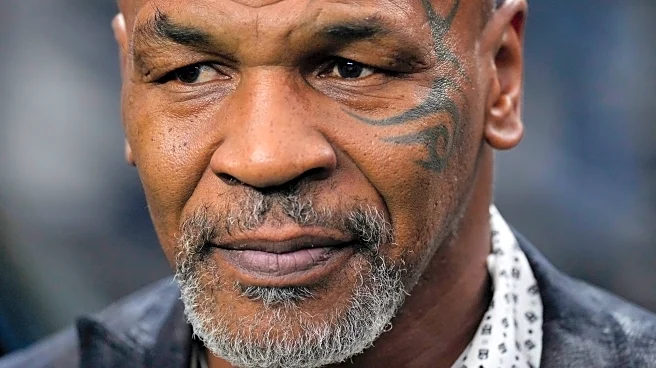

AD

The investigation into Dow Inc. by Pomerantz LLP highlights potential legal and financial repercussions for the company and its investors. If securities fraud or other unlawful practices are confirmed, Dow could face substantial legal penalties and damages, impacting its financial stability and investor confidence. The decline in stock price reflects market concerns over the company's financial health and governance practices. This situation underscores the importance of transparency and accountability in corporate financial reporting, which can significantly affect investor trust and market performance.

Affected investors are advised to contact Pomerantz LLP to join the class action lawsuit. The investigation will likely proceed with gathering evidence and testimonies to substantiate claims of securities fraud. Dow Inc. may need to address these allegations publicly and take corrective measures to restore investor confidence. The outcome of this investigation could lead to legal actions and settlements, influencing Dow's future financial strategies and corporate governance policies.

This investigation may prompt broader scrutiny of corporate governance practices within the industry, potentially leading to regulatory changes or increased oversight. It also raises ethical questions about corporate responsibility and the impact of financial misreporting on stakeholders. Long-term, this could influence investor behavior, with increased demand for transparency and accountability from corporations.

AD

More Stories You Might Enjoy