Rapid Read • 7 min read

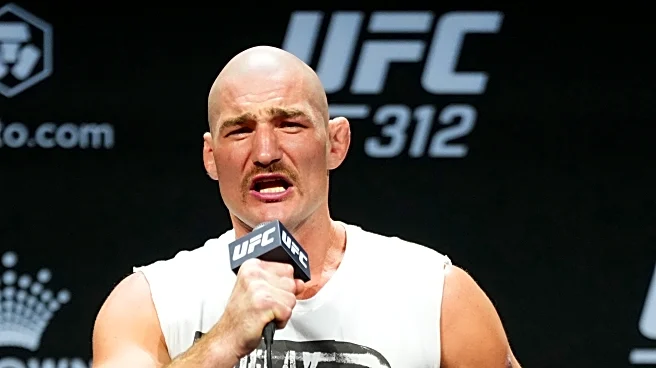

Federal Reserve Governor Lisa Cook has publicly stated her refusal to resign following accusations from President Trump and his appointee, Bill Pulte, regarding alleged mortgage fraud. Pulte accused Cook of claiming two primary residences to secure better mortgage terms, a claim that Cook has denied. President Trump has called for Cook's resignation, intensifying his administration's efforts to exert control over the Federal Reserve, an independent agency. Cook, appointed by former President Joe Biden, has expressed her intention to address any legitimate questions about her financial history, while maintaining her position at the Fed.

AD

The situation highlights ongoing tensions between the Trump administration and the Federal Reserve, particularly regarding interest rate policies. President Trump has been critical of the Fed's Chair, Jerome Powell, for not reducing interest rates, which he believes would benefit the housing market and reduce government borrowing costs. If Cook were forced to resign, it could allow Trump to appoint a loyalist, potentially shifting the Fed's policy direction. This development underscores the broader political struggle over the independence of the Federal Reserve and its role in shaping U.S. economic policy.

Should President Trump pursue Cook's removal, it could lead to a legal battle over presidential authority to dismiss Federal Reserve governors. Senate Democrats have expressed support for Cook, criticizing Trump's actions as attempts to intimidate Fed officials. The outcome of this situation could impact the composition of the Fed's governing board and its future policy decisions, especially with upcoming opportunities for Trump to appoint new members.

The controversy raises questions about the ethical and legal implications of political interference in independent financial institutions. It also highlights the potential long-term impact on the Fed's ability to operate free from political pressure, which is crucial for maintaining economic stability and investor confidence.

AD

More Stories You Might Enjoy