MUMBAI (Reuters) - The Reserve Bank of India (RBI) kept its key repo rate steady at 5.50% on Wednesday, in line with expectations, as policymakers waited to see the impact of recent rate cuts amid rising

global trade uncertainties.

The six-member rate-setting panel held the policy rate with a unanimous vote and decided to continue with a “neutral” stance.

Global trade challenges continue to linger but prospects for the Indian economy remain "bright", Governor Sanjay Malhotra said in his statement.

While headline inflation is much lower than expected, it is largely due to volatile food prices, Malhotra said.

A large majority of economists, 44 of 57, had forecast a pause in a July 18–24 Reuters poll, following a surprise 50 basis point cut in June.

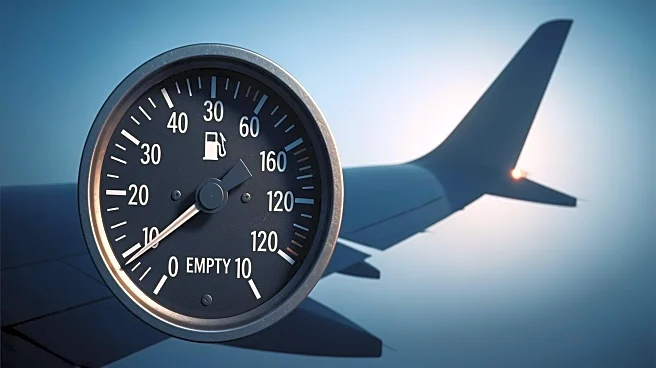

The central bank has cut the policy repo rate by 100 bps so far in 2025 as price pressures ease, but U.S. President Donald Trump is ramping up threats to raise tariffs on goods from India over its Russian oil purchases.

Inflation slowed to a six-year low of 2.10% in June and is expected to fall to record lows when July data is released next week, before picking up again later in the year.

India's economy is expected to grow by around 6.5% in the current fiscal year but a 25% U.S. tariff on imports from India could shave off up to 40 basis points from that level, while stunting business investment, economists have said.

Traders are also awaiting details of a revised liquidity framework, which may be announced alongside the policy decision.

(Reporting by Swati Bhat and Sudipto Ganguly, editing by Kim Coghill and Mrigank Dhaniwala)